Why Stake Mina

Mina is the lightest layer 1 blockchain because it uses advanced cryptography and recursive zk-SNARKs so that the network size can be designed as small as possible.

The Mina protocol has many advantages, apart from size, also in staking.

High APR

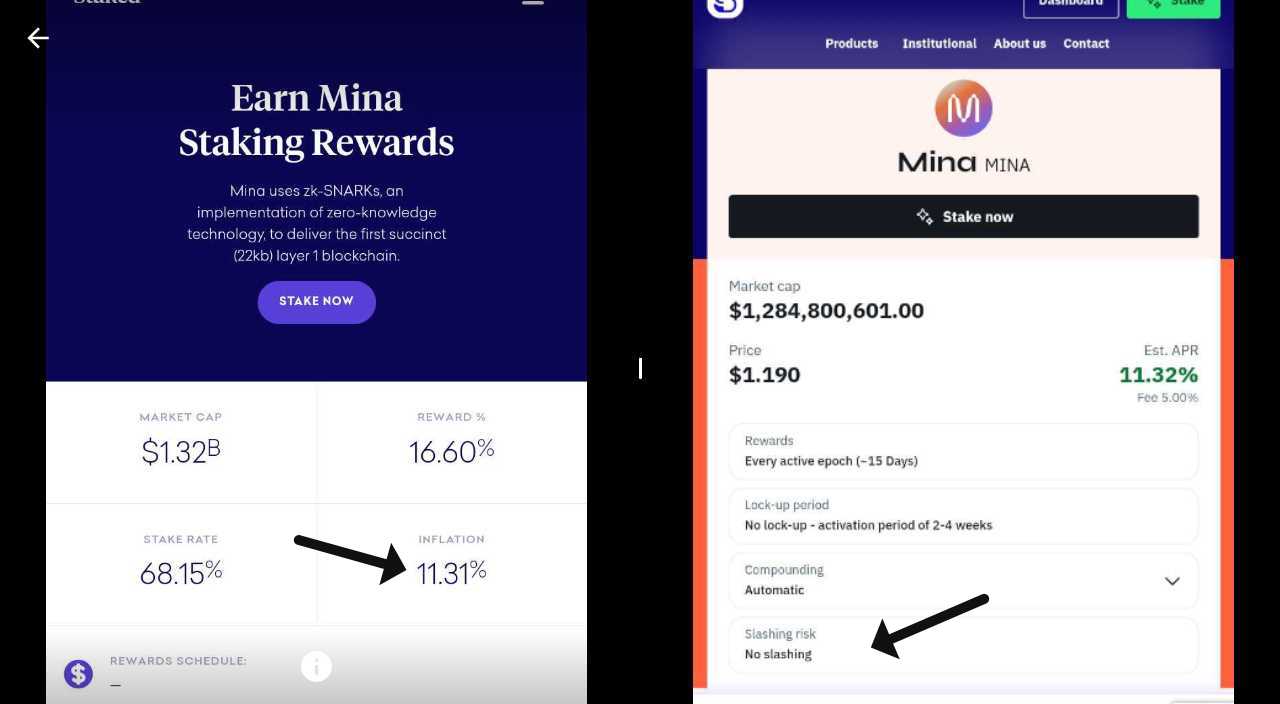

Several staking providers offer Mina staking with high APRs varying from 11% - 27% with their respective features and advantages. This reward is high compared to Cardano at around 3%-4% at most staking providers.

Another feature is Supercharged Rewards system where tokenholders with fully unlocked tokens receive a higher block rate for the first 14 months. This is to anticipate inflationary risks to foster a high staking ratio and an orderly market.

Minimal risk

One of the main advantages of staking Mina is the minimal risk either from the protocol itself or from the staking provider. For example, Stakin provides detailed descriptions regarding rewards, lock periods and slashing risks. Another provider, Staked, provides estimates regarding inflation, stake rate, rewards, and market cap.

Slashing is a common problem for most PoS tokens. For example, Cosmos, even though it has a high APR, carries the risk of slashing both downtime and double signs. Another blockchain, Kusama, has multilevel slashing risks ranging from unresponsiveness and misconduct. This risk will hamper block production and distribution.

Another risk is the lock-up period. Some blockchains require locking assets for some time before staking. This can be two-sided in that it can maximize returns as well as risk penalties and delayed rewards.

Several other providers such as Staketab provide comprehensive documentation regarding the delegation process to reward distribution visit, while Auro provides complete guidance such as holder types, the right time for staking, timeline, etc. visit, making it easier for stakers to understand the staking process and avoid the risks involved.

Although in general each token carries its own risks and each provider also has different staking risks related to staking rules, node performance, reputation, track record, etc.

Staking independently

Another advantage of Mina is that it allows independent staking.

Even though they both use the Ouroboros protocol, Mina is different from Cardano. Cardano requires stakeholders to delegate assets to Stake Pool and it is only run by specialized operators whereas Mina implements zero knowledge smart contracts with easy programmability and implementation allowing individuals to run their own nodes.

There is a difference in the staking and delegating processes because staking Mina requires nodes to be online and connected to the Mina network, some nodes will choose to delegate to another active nodes. The advantage of staking independently is the opportunity to get rewards in full.

Other factors

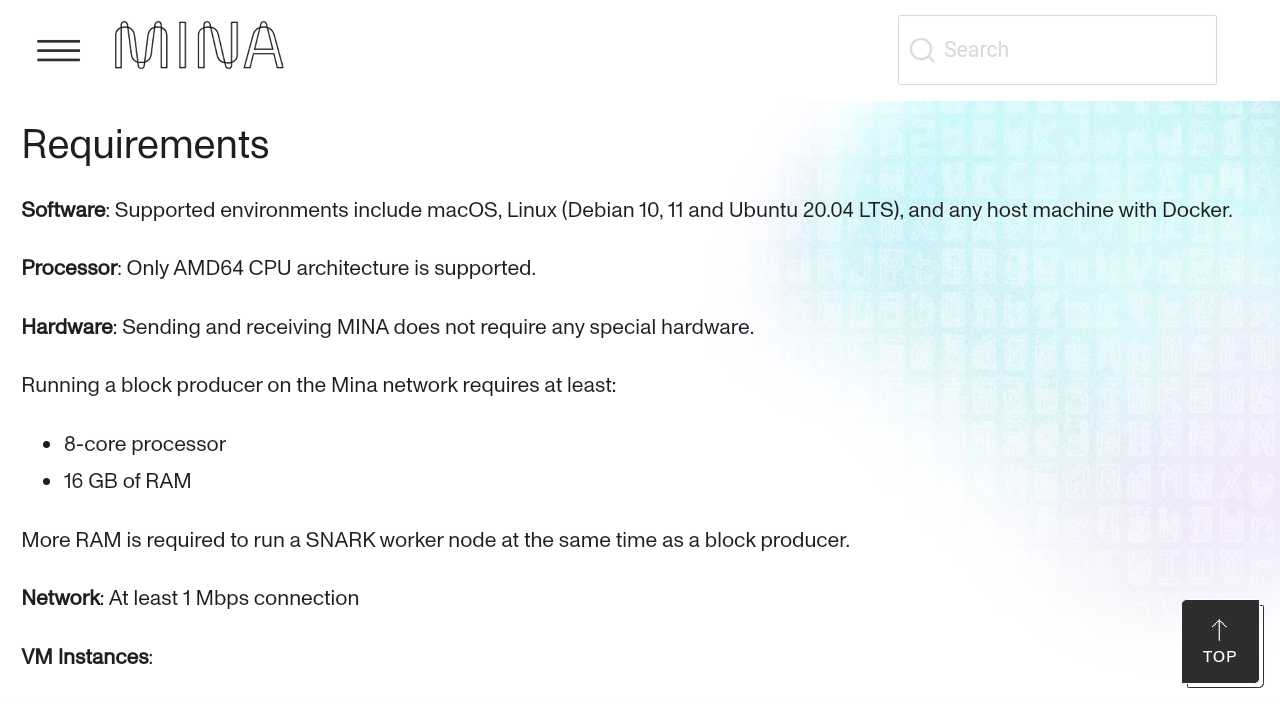

Mina also has other advantages such as auto-compound feature that can maximize interest and returns, support for low hardware specifications so that operational and transaction costs can be minimized, as well as an active community and diverse staking pool.