To understand leveraging, check up this post, then balance it with these examples stated in this post. [Post Link](https://steemit.com/hive-150122/@bossj23/understanding-leveraging-in-crypto-trading)

Long and Short Positions Trade With Leverage

|

|-

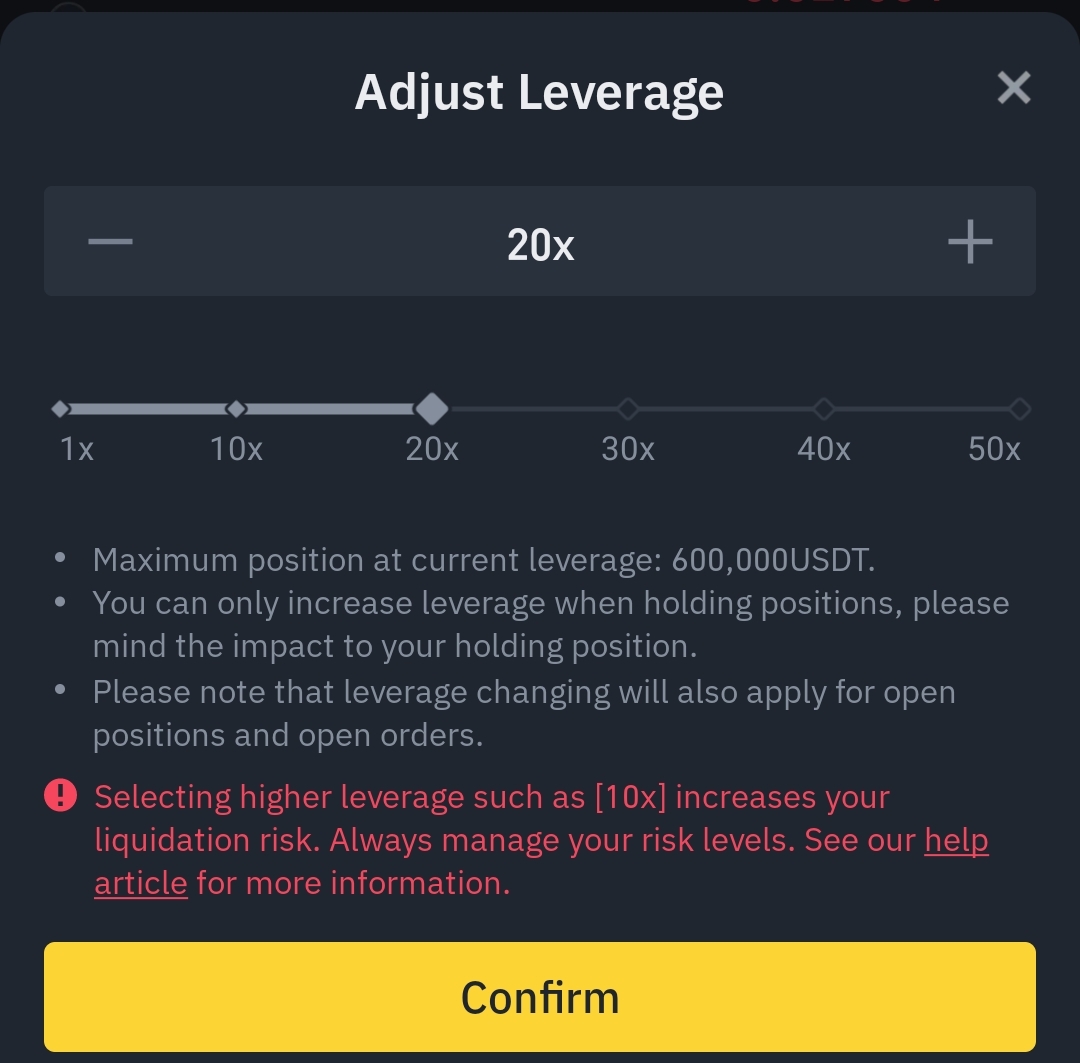

To take up a long position leverage, let's use this example to illustrate. Let's imagine you take all the position of **$10K what of ethereum with 10x leverage, you will use $1,000 as collatera**l. But if the price of ethereum rises by 20% you earn a net profit of **$2,000 which is way higher than the $200 you would have made if you are traded with $1,000 capital without leverage**. If the price update ethereum drops by 20%, your position will be down by $2,000.

|

---|----

Since your collateral is only $1,000, the drop by 20% with trigger liquidation and your balance will drop to zero. Even if the market only drops 10% you would you could face the liquidation. This liquidation value would depend on the exchange used. To avoid this liquidation, you must add more phones to your position to increase your initial capital.

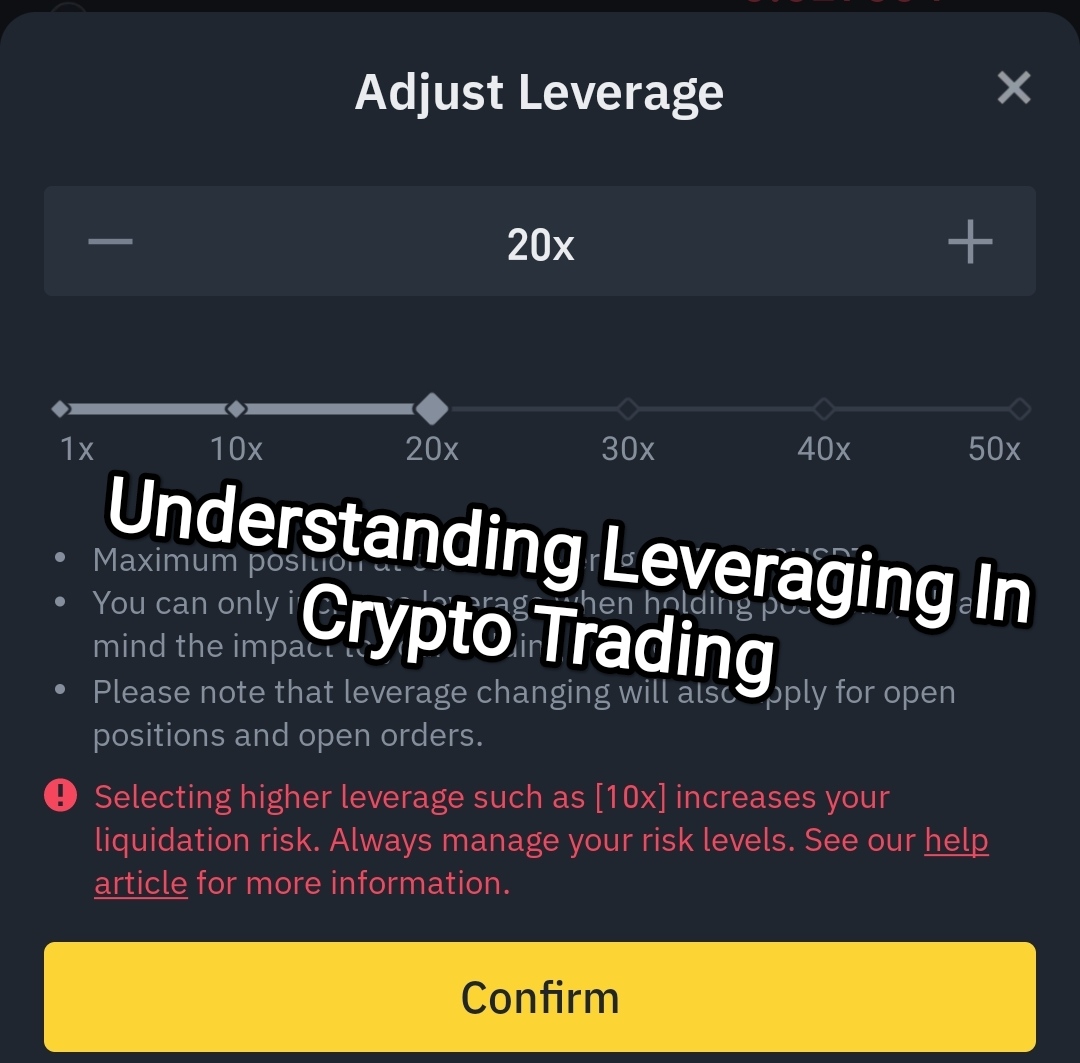

In most cases, the exchange will send you a margin call before liquidation i.e liquidation call of 80% drop via email, telling you to add more funds or exit the market if you want to. This is illustrated in the case of trading a long position trade of BTC with $100 and a leverage of 10x. If the market goes up you if the market goes up you if the market goes up, you want really be in profit compared to when using 20x leverage.

This leverage speeds up your profit on a trade. Inversely, **if you open a trade on BTC on a long position and uses a leverage of 10x, your losses will not really speed up compared to when using 20x when the market drops badly**. So to avoid these liquidations in the market, you must first of all consider your capital and leverage before entering a trade.

Opening a leverage on short position can be illustrated using the example below. If you want to open a **$1,000 short position on BTC, using 10x leverage will mean you are boring BTC from someone else and sell it at the current market price**. Your collateral is $1,000 but since your trading the position with 10x leverage, you could sell $10k of BTC.

**Let's say the current price of Bitcoin is $40,000, you would have borrowed 0.25 BTC and sold it. If the price reduces by 20% to $32,000, you can buy back that 0.25 BTC for just $8,000**. This would bring about a net profit of 2K dollars. But if it increases by 20% to $48,000, you will need an extra $2,000 to buy back that 0.25 you will need an extra $2,000 to buy back that 0.25 ethereum BTC. Your position would be liquidated in this case as you have only $1,000 in your balance.

**_To avoid this liquidation, you must add more dollars to your wallet to increase your collateral or initial capital before the 80% liquidation is reached._**

Why do we use leverage to trade crypto?

|

|-

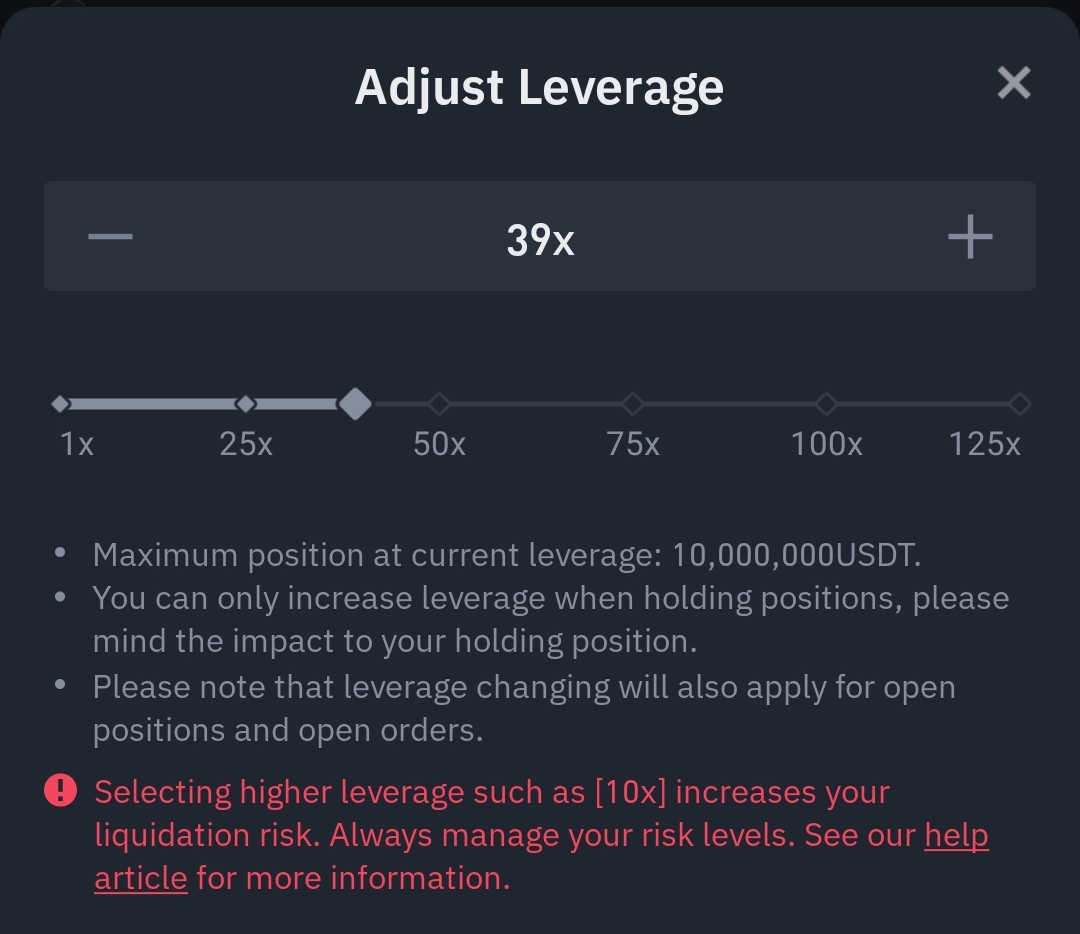

Traders use leverage to increase their position size and profits. Leverage trade in could also lead to significant losses by trades open by these traders. Enhancing the liquidity of the initial capital is another reason Traders uses leverage to trade. They use 20x leverage instead of holding a 10x leverage position on a single exchange to maintain the same size of position with lower initial capital.

This would allow them to use the rest of their money in another place such as taken and **providing liquidity to Dex**. To manage leverage trading risks, Trader should consider their starting on initial capital to avoid liquidation. Trading with a high leverage may need a lower capital but it increases your risks.

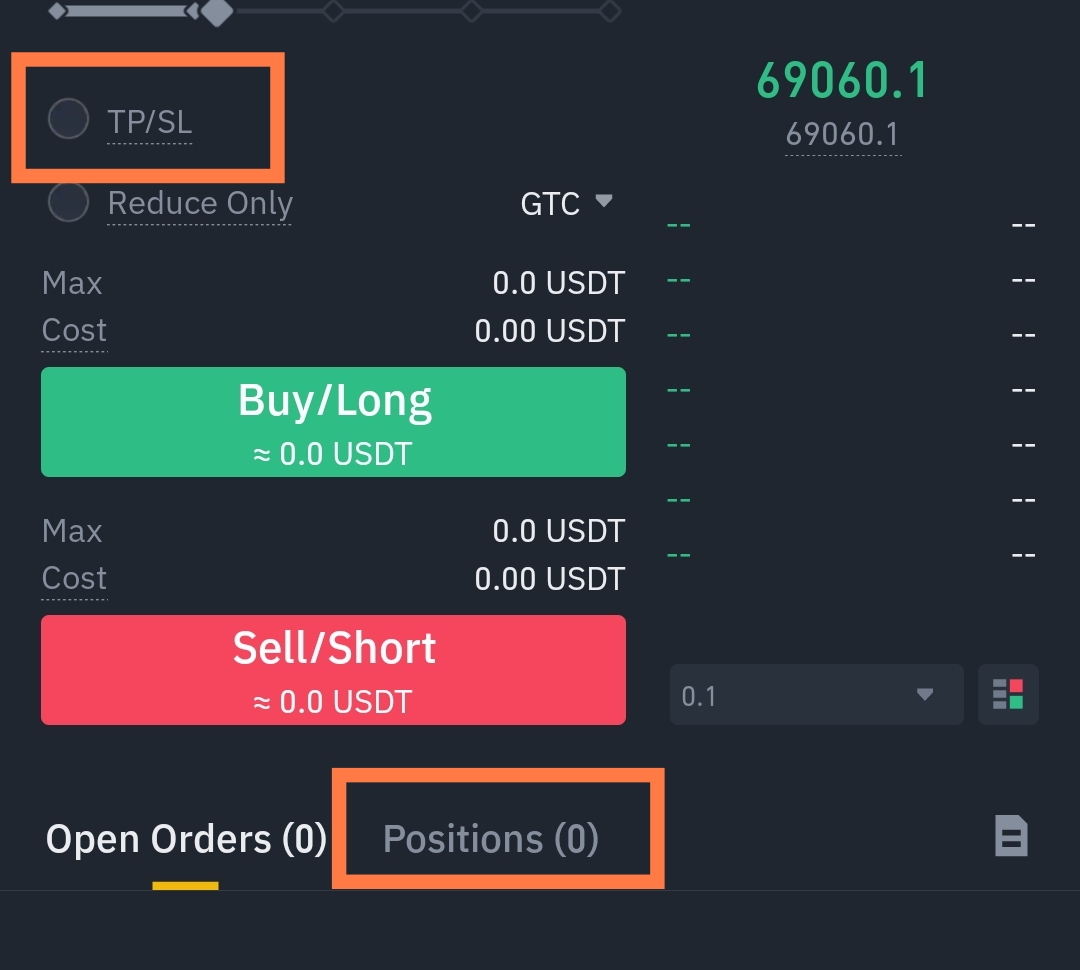

**The higher the leverage, the smaller your volatility tolerance. The lower the leverage, the higher the volatility tolerance**. If your leverage is too high, 1% movement decrease can lead to serious losses. Using lower leverage gives you a wider margin of error. Risk management like **stop-loss and take profit orders help minimize losses in leverage trading.**

[Source](https://www.google.com/url?sa=t&source=web&rct=j&opi=89978449&url=https://www.binance.com/en-NG/square/post/288319%23:~:text%3DIs%2520it%2520a%2520really%2520fast%2520way%2520to%2520make%2520money%253F,-LIVE%26text%3DLeverage%2520on%2520Binance%2520is%2520a,positions%2520in%2520a%2520particular%2520market.&ved=2ahUKEwjnyaeBj7GFAxV7QEEAHU2wB78QFnoECBMQBQ&usg=AOvVaw3Y2-EXkTq6DNFAG8nA3JPr)

> **Disclaimer** :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have