Understanding The Trix Indicator in Trading Crypto..

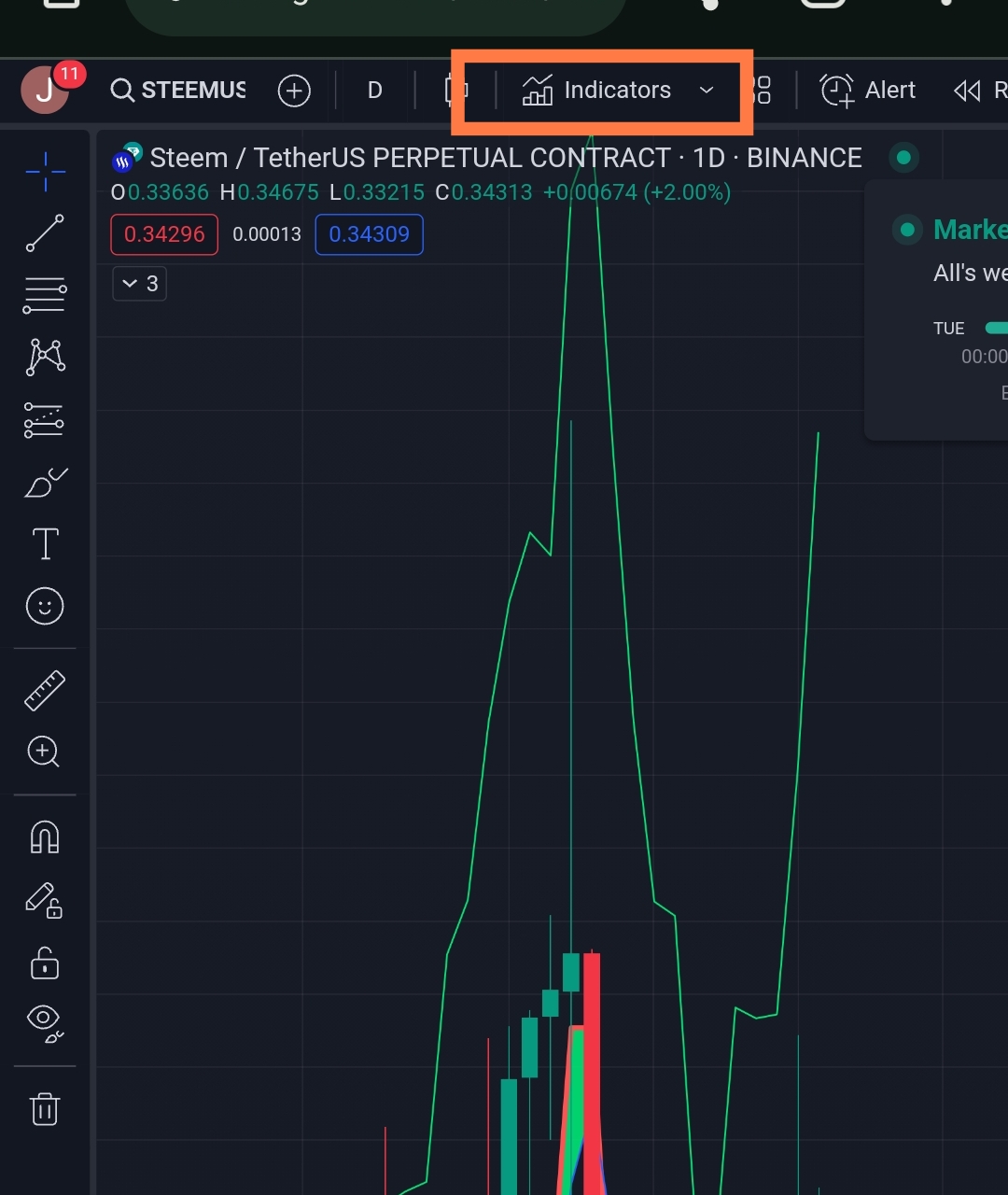

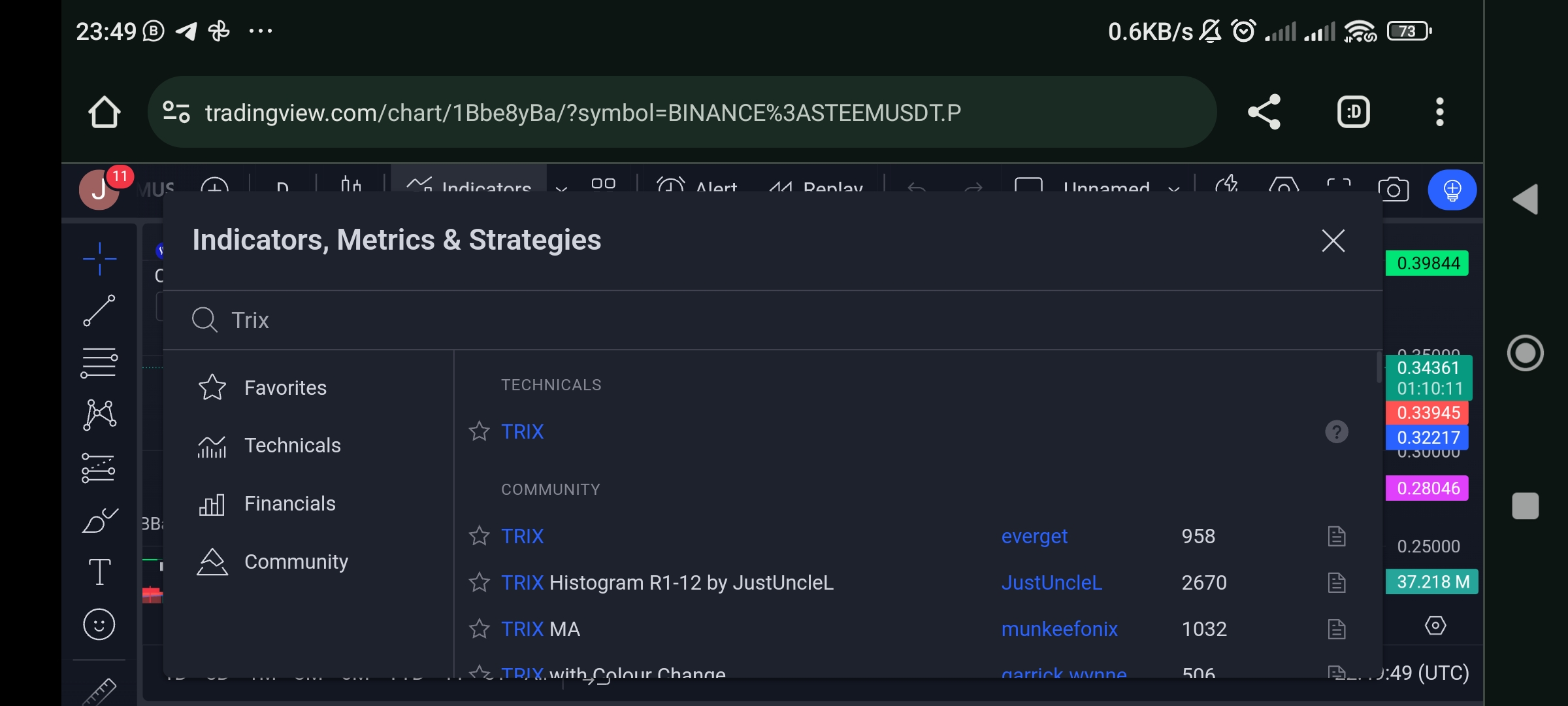

screenshot from my trading view

In this post, we will be looking at Trix indicator in crypto trading. Last post, I talked about fractal indicator and how Traders use this indicator to make good decisions on trading. In this particular type of indicator, we will see how Traders can use this to analyze and predict the price movement of assets in the future. These indicators are important technical analysis tools used to utilize past or historic price data which helps to predict the movement of future price of assets.

To understand this trix indicator and how it works, let's take the definition. Trix indicator is known as triple exponential average and is an indicator developed by the smoothing of three exponential moving averages.

This exponential moving average reacts faster to price which makes it very much prone to sharp price fluctuations in the market which can be unnecessary movement in prices of an asset that can generate false or misleading signals to traders who may take or make wrong decisions.

This indicator is calculated by taking into account three exponentially moving averages which smoothens the trix indicator to generate accurate information when it comes to price. Combining these three exponential indicators can filter out unnecessary price fluctuations in the market and trading signals that are accurate would be generated.

The crypto market is so volatile that we see dumbs and pumps in the market. In splits of seconds, you will see an increase and then a decrease. Failure to use these indicators and basing your decisions on probabilities may lead to sad consequences. Through the use of this indicator, it filters the noise in the crypto market.

It also plays a major role in obtaining future price markets and trend changes though the indicator doesn't indicate exit and entry points in the markets. With these crypto information, other technical analysis tools can be used to get an entry into the market.

|-

This Trix indicator works more like the exponential moving averages. The normal exponential moving average indicator helps to identify the market trends and this is done by drawing a line that is dynamic on the chart. The exponential moving average was developed to filter or correct lags in simple moving averages which adds with to its calculation.

This exponential moving average achieved this by reacting fast to current movement in price. Even as this is beneficial, the exponential moving average reacts to unnecessary movement and fluctuations in the crypto markets making Traders fall for price manipulations as the exponential moving average is cannot filter the noise in the crypto market.

The solutions to issues in exponential moving average as discovered by Jack Huston can be filtered by modifying its calculation. How? This modification can make trader see smoother chart that filters the noise in the market and the unnecessary price fluctuations that seems inevitable.

This Trix indicator looks like that of the macd which oscillate above and below a zero line and this movement make signals trading information in the market that are accurate.

The Trix indicator is used in determining price reversals using divergence between the indicator as well as the price on the chart. The cross of the Trix indicator above the zero line signals a movement that is bullish, whereas a cross below the zero line signals a movement that is bearish.

|  |

|---|

The Trix indicator helps traders make good trading decisions in terms of the identification of trends and the buy and sell signal in the market. It offers good trading signals compared to other indicators like the EMA and MACD in some cases.** Although the **trix indicator gives bad signals at times, combination with other indicators can make it strong.

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have