Can Bitcoin Overcome $70,000 Resistance?

Bitcoin's recent price movements have put short sellers on edge, with significant liquidations looming if the cryptocurrency returns to the $70,000 mark it last touched 12 days ago.

Stakes High for Bitcoin Shorts

According to data from CoinGlass (https://www.coinglass.com/pro/dashboard/bitcoin), approximately $1.67 billion worth of Bitcoin short positions are at risk of liquidation if BTC reaches $70,000 again. This price threshold, not seen since June 8, represents a critical point for many traders.

Market Sentiment and Expert Views

Bitcoin is down 3.23% over the past seven days. Source: CoinMarketCap

Crypto analysts and traders are closely watching Bitcoin's movement, anticipating potential liquidations and market dynamics.

Pseudonymous trader Ash Crypto highlighted the buildup of short liquidations, emphasizing the precarious situation for those betting against Bitcoin's rise.

Optimism Amidst Uncertainty

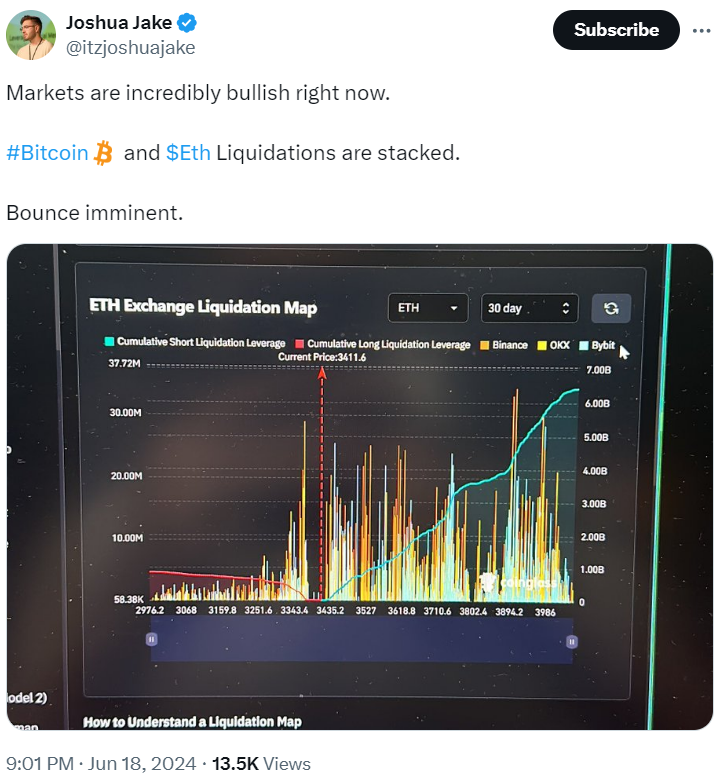

Despite the risk for short positions, some market observers remain bullish. Discover Crypto CEO Joshua Jake noted optimism in the market, suggesting a potential bounce in Bitcoin's price.

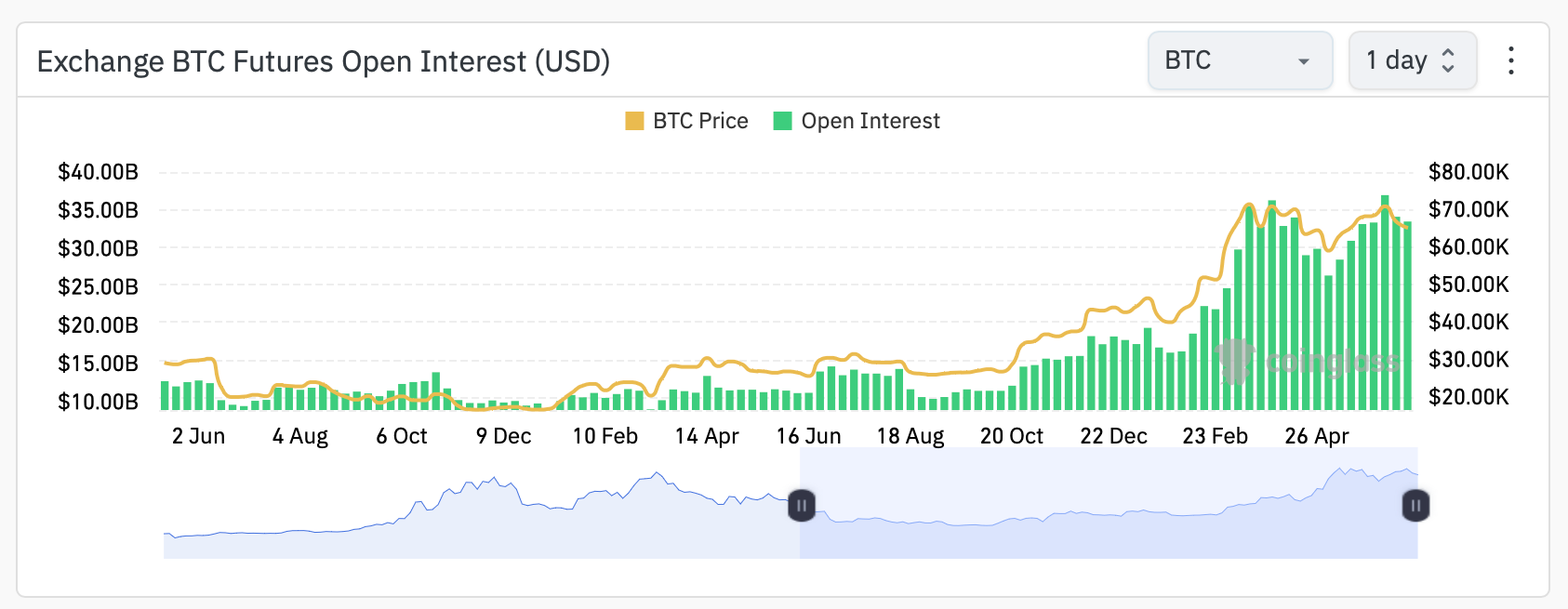

Open Interest and Market Dynamics

Bitcoin's open interest (OI), a key indicator of trading activity, has recently decreased by 10.99% from its peak on June 7, signaling shifting market sentiment and potential volatility.

Strategic Liquidations for New Highs

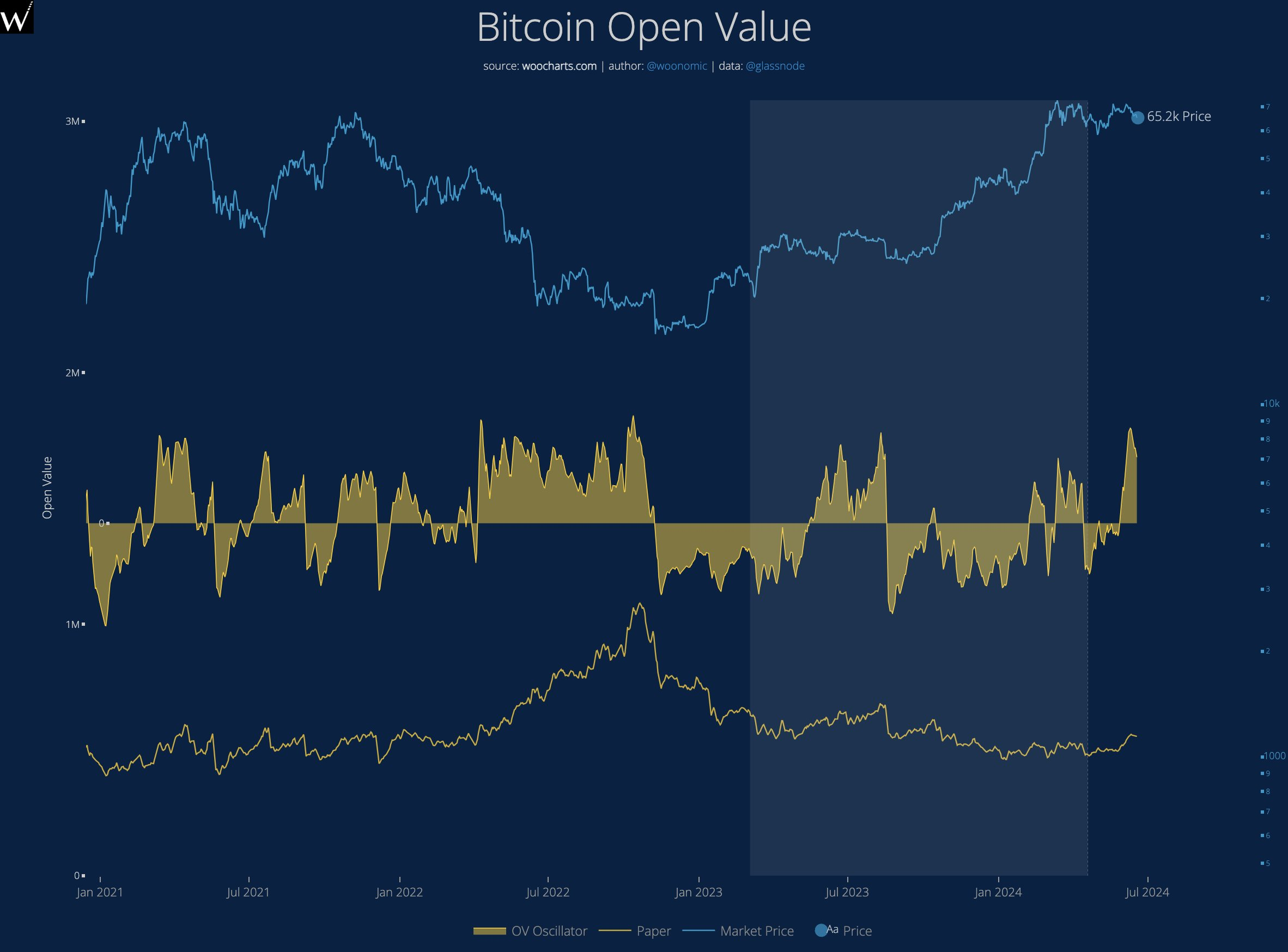

Crypto analyst Willy Woo discussed the necessity of significant liquidations to pave the way for Bitcoin to reach new all-time highs. Woo emphasized the importance of market adjustments and resilience amidst price fluctuations.

Long-Term Outlook and Investor Patience

Despite short-term volatility, analysts like Woo cautioned that sustained bullish momentum might require further market adjustments and patience. The aftermath of Bitcoin's recent halving event continues to shape market dynamics and investor sentiment.

As Bitcoin approaches the $70,000 mark, the cryptocurrency landscape remains dynamic and uncertain. Traders brace for potential liquidations, while analysts and market participants navigate evolving market conditions in anticipation of future price movements.