Top Reasons Why Bitcoin Price is Falling?

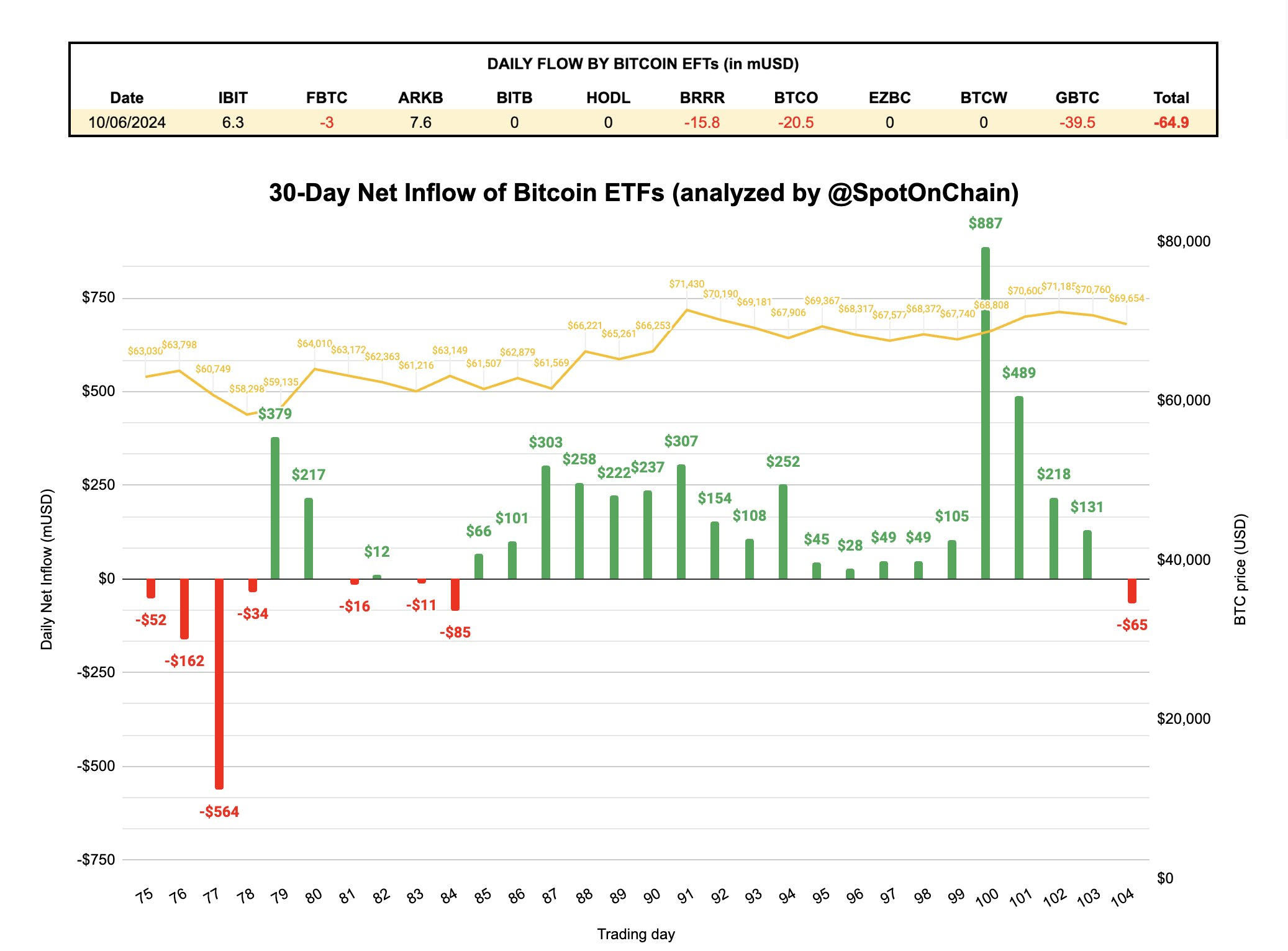

Bitcoin, the world's largest cryptocurrency, has been experiencing selling pressure as traders worry about the Federal Reserve's upcoming decisions on interest rates. After 19 consecutive days of inflows, Bitcoin ETF flows turned negative on Monday.

Bitcoin Under Pressure

In the last 24 hours, Bitcoin's price dropped by an additional 2%, falling below $68,500. This decline comes as traders anticipate that the Federal Reserve will maintain higher interest rates for an extended period due to strong jobs data.

Fed to Maintain Higher Interest Rates

Last week, while the European Central Bank and the Bank of Canada cut interest rates, the Federal Reserve is expected to keep rates elevated. The strong jobs data reported last week supports this expectation.

Bitcoin reached a record high of $73,798 in March, driven by inflows into US exchange-traded funds (ETFs). However, it has struggled to reach new highs since. The upcoming inflation data and the Federal Reserve's outlook on Wednesday could heighten concerns that interest rates will remain high, creating a tough environment for speculative assets like cryptocurrencies.

Market Sentiment

Anand Gomes, co-founder of the derivatives platform Paradigm, told Bloomberg, “No news is bad news in crypto. The market is like a junkie that constantly needs bullish news to stay up. So when there is none, the path of least resistance is lower.”

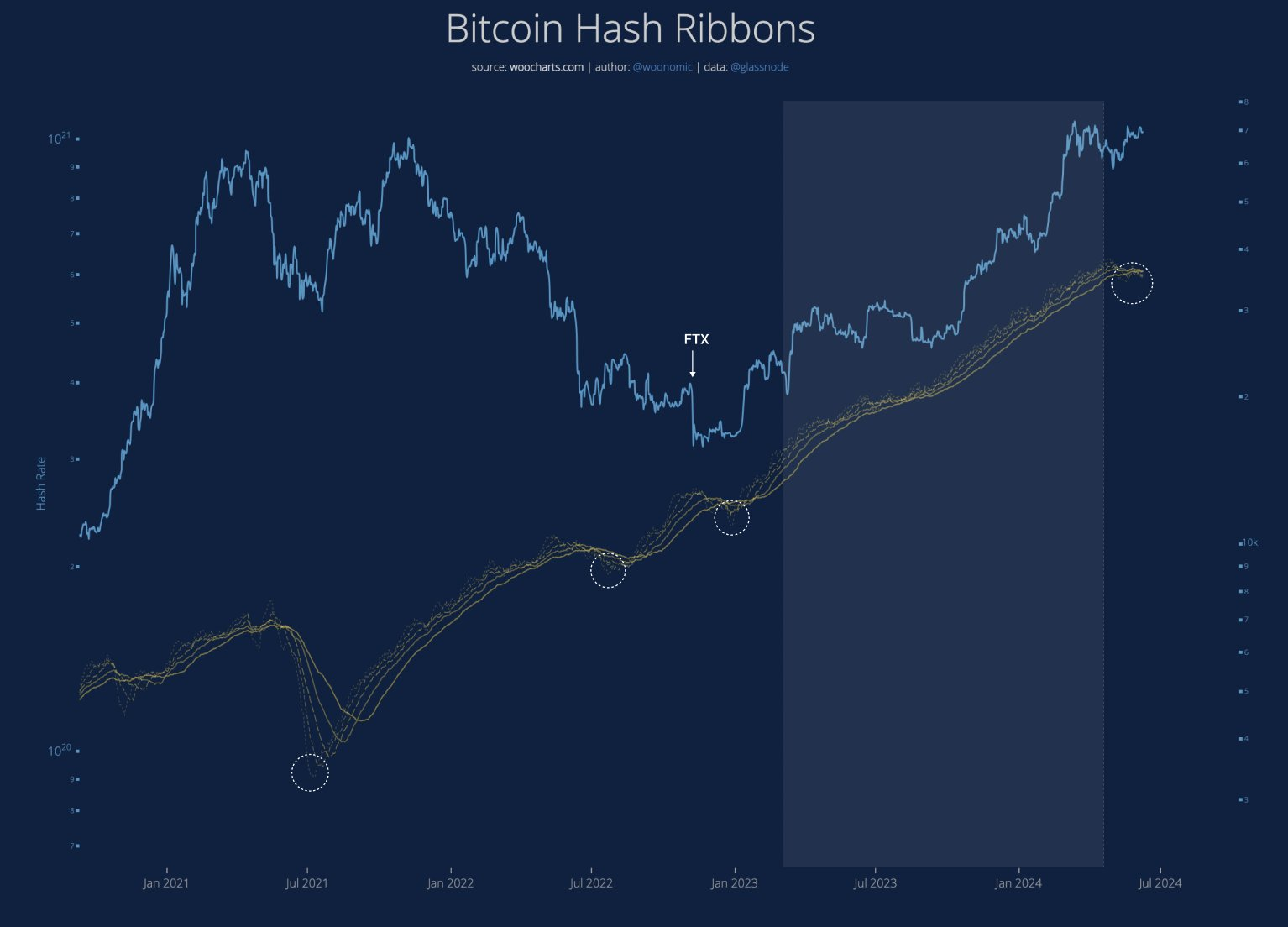

Miner Capitulation

Bitcoin analyst Willy Woo noted that Bitcoin is currently experiencing a rare miner capitulation, related to the recent halving event. This process tends to eliminate weaker miners, who then sell off their BTC holdings. According to Woo, Bitcoin's price typically rebounds after such sell-offs. However, he cautioned that a price surge would require clearing out excessive speculative interest in BTC futures markets. “Liquidations need to happen before a pump,” he emphasized.

ETF Outflows

On June 10, Bitcoin spot ETFs recorded a total net outflow of $64.9318 million, marking the first net outflow after 19 days of net inflows. Grayscale ETF (GBTC) saw a significant single-day outflow of $39.5366 million. In contrast, Bitwise ETF (BITB) recorded an inflow of $7.5910 million, and BlackRock ETF (IBIT) reported an inflow of $6.3433 million.

The negative shift in Bitcoin ETF flows, coupled with the Federal Reserve's stance on maintaining higher interest rates, is creating a challenging environment for Bitcoin and other cryptocurrencies. As traders and investors navigate these turbulent waters, the market remains on edge, awaiting further developments.