Will Ethereum ETFs Get Approval Next Week?

My Dear Readers,

Issuers of spot Ether exchange-traded funds (ETFs) are anticipating imminent regulatory approval, signaling potential listings as early as next week.

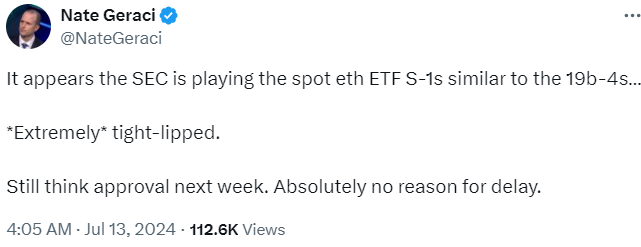

Final Regulatory Milestone Expected Soon

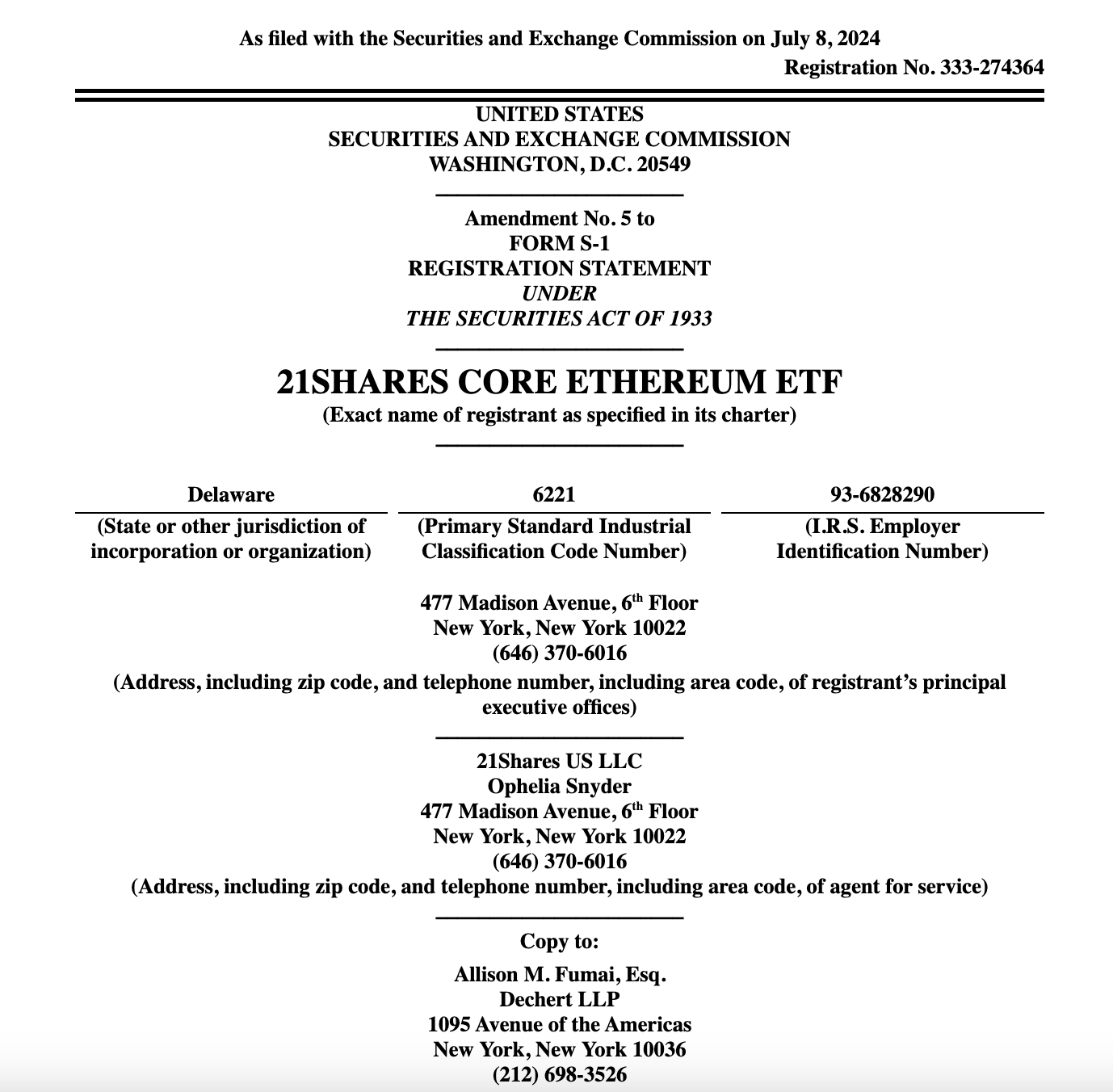

Industry insiders reveal that spot ETF issuers, including VanEck and 21Shares, are awaiting final comments from the United States Securities and Exchange Commission (SEC). Sources indicate a decision could arrive as early as July 12, marking a critical step toward ETF listings.

Market Potential and Analyst Insights

Analysts project substantial market interest in ETH ETFs, foreseeing potential inflows of billions of dollars post-listing. Mark Dunleavy, a crypto analyst, highlights ETH's comparatively constrained availability on exchanges, predicting heightened price responsiveness to ETF-driven demand compared to Bitcoin.

Institutional Interest and Market Dynamics

Significant demand is anticipated from crypto-native hedge funds, which hold substantial self-custodied ETH reserves. These funds are reportedly preparing to engage institutional market makers to convert ETH holdings into ETF shares, underscoring robust market readiness.

Comparison with Bitcoin ETFs

Following January's regulatory clearance, spot Bitcoin ETFs have amassed over $50 billion in assets. Similar momentum is expected for ETH ETFs, with projections suggesting potential inflows nearing $10 billion in the months following approval.

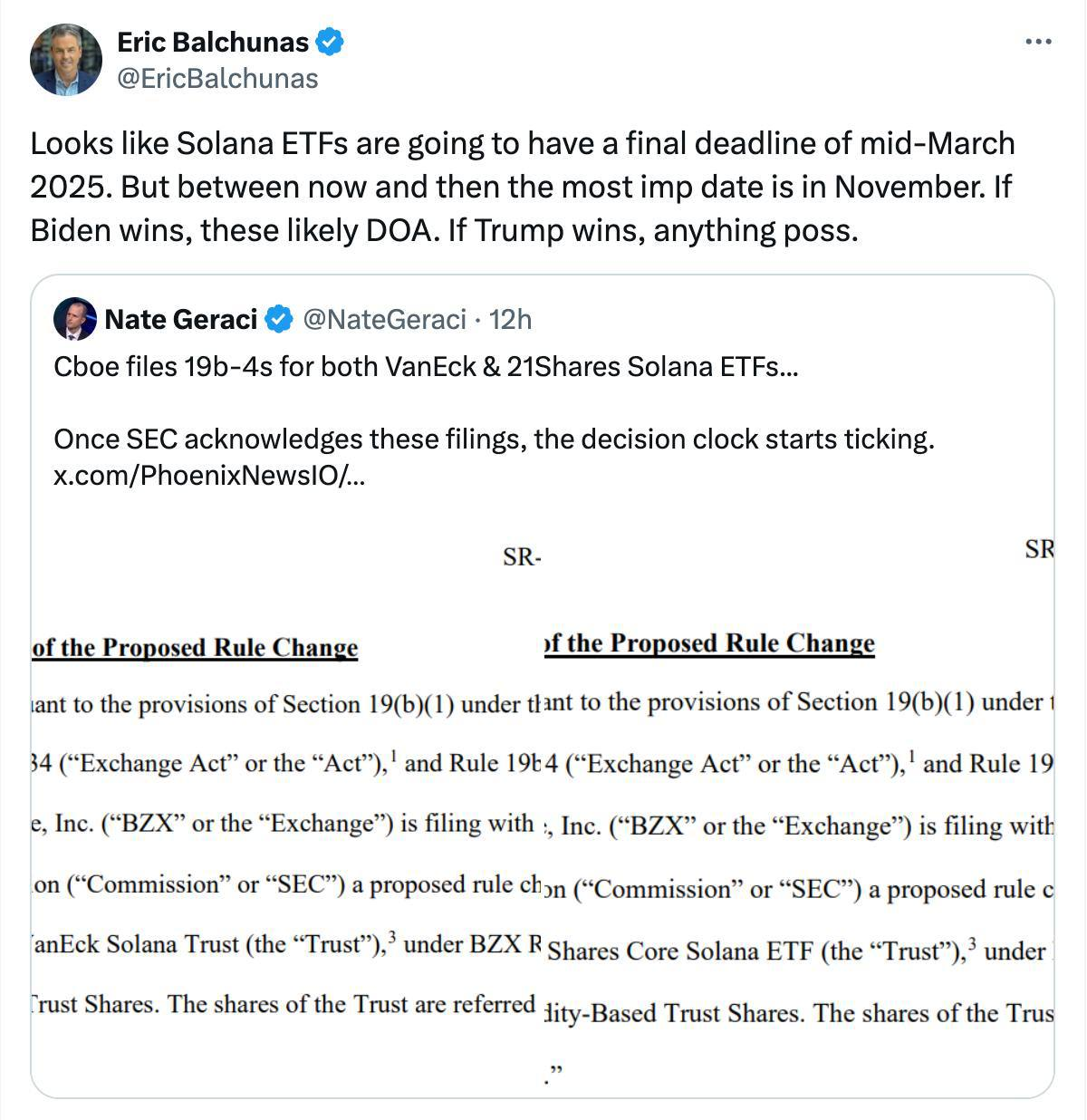

Future Outlook: Spot Solana ETFs on the Horizon

Looking ahead, the ETF landscape may expand further with the introduction of spot Solana (SOL) ETFs, poised to begin trading as early as next year. This expansion underscores growing investor interest in diversified crypto ETF offerings beyond Bitcoin and Ethereum.