||

|------|

|

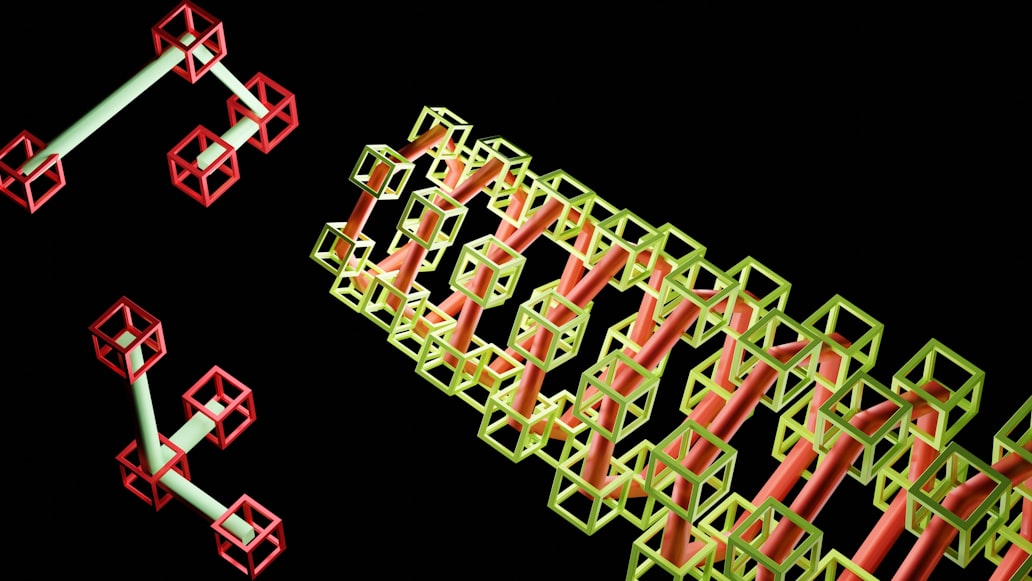

[unsplash](https://unsplash.com/photos/diagram-22URjQNjHTs)|

|-------|

Hi friends. Good to have you here once again, I hope we are all keeping well. Welcome to my blog.

I trust we enjoyed the last publication, well I would love to continue the topic.

We talked about Defi and how it has shaped the financial realm. This time we would be looking at it pros and cons. This knowledge is very key, as it would help us know the benefits and limitation of the defi system. Let's get into it right away.

|**Pros of Defi System**|

|----------|

• **Permissionless:** Defi is permissionless and open to all. The word permission there is just as literal as the word. You do not need some form of permission or approval to enjoy these financial service. Your only limitation, if any would be your device and internet connection.

Once you have a device and an internet connection, you can take advantage of these defi services. You can trade, transfer and do all manner of stuffs on the defi platform and bypass all these limitations peculiar with conventional financial systems.

• **Real Time transaction:** when it comes to defi, all transaction are carried out in real time. There is actually no delay as every transaction is recorded on the block chain. This is one advantage defi has over most conventional financial system which sometimes pend urgent transaction.

Sometimes it takes more than 24 hours for a transaction to be completed, this might be due to their network but I believe there is always a place for improvement and this is what the defi system aims to achieve. Leveraging on the flaws of these traditional systems.

• **Transparency**: Transparency is one key feature of the blockchain making all transaction verifiable by any user. In fact any and everyone can check the activities of these platform because it is open for all to see. I believe transparency is one of the core reason why users find it a bit easy to trust these platform.

Ethereum which seems to shoulder more than 90% of all defi activities allows users to check out it activities as transactions are broadcasted to them and also verified by them.

• **Automatic Execution**: Defi is also designed to execute transaction automatically as long as the conditions for the execution are met. This is possible with the help of smart contract. Smart contract ensures that you have a seemless transaction with another user which is usually unknown.

|[unsplash](https://unsplash.com/photos/person-holding-smartphone-beside-tablet-computer-Xn5FbEM9564)|

|---------|

Once the conditions are met, the contract will be executed. By so doing, the smart contract has eliminated middle men/intermediaries that would have offered this at a professional cost.

• **Open Source**: Most Defi protocol are open source meaning they could be viewed and audited and most especially they could also be built on. Developers do not need permission to connect multiple Defi application on these open source protocols to create more beneficial financial services.

• **Immutable**: Data on a defi protocols are usually immutable, they can't be tampered with neither can they be altered. This is because they are powered by blockchain and any data recorded on these chains remain for life.

This also has contributed to the trust and confidence that users have in defi because manipulations is quite impossible.

|**Cons of Defi**|

|----------|

• **Threats**: Defi is still a technology with many loopholes, it's still being worked upon daily to make it super dope but then, hackers are also on their toes to ensure they break into these protocols for their personal gains.

|[unsplash](https://unsplash.com/photos/man-siting-facing-laptop-dYEuFB8KQJk)|

|----------|

There have been a successful attack in the past, an example is the **White hat** attack in 2021, these guys successfully stole a whopping sum of $160million from a defi platform called Polynetwork. It was later recorded that these funds were restored.

• **Collateral Requirement**: From findings, the collateral requirement for lending on most defi platform is quite high. It is true that it's is very easy to lend on this platform when compared to the traditional financial system but then the issue of collateral seem to be a salient challenge.

You might need to drop 100% collateral of the value of what is to be lent from the defi platform. I believe the reason on their path is to be on a safer side and not have people dash away with their resources.

• **Consumer's Protection**: sadly defi cannot guarantee consumers protection because it not regulated, neither are there rules guiding their activities. In other words, when thing go wrong while trying to get their service, there might not be adequate support for you.

It's a risky venture and path that has to be threaded carefully. Maybe we would see some sort of improvement as time goes on.

• **Still in the infancy stage:**Defi technology is still very young and immature, still being tested and we can't attest to it being "fully trusted". Anything negative can still happen in the course of using these platforms. One could lost his or her fund or encounter some glitch which could cost one.

• **Users interaction**: Users who have gotten used to the simplicity that comes with the traditional financial system might find the use of Defi a bit difficult since most of these defi protocols are propelled by smart contract and some technological algorithm they ain't familiar with.

This would then require that they take their time to learn (which might not be visible for many) or just continue with their conventional style. This alone is one major draw back

|**Bottom Line**|

|----------|

Having learnt all of these, I can now say that the ball is in our court, we need to deal carefully with this defi technology and learn how to get the best out of it.

There you go friends.I would love to wrap it up at this juncture. I want to believe you've gotten so much from this piece. As my usual custom is, I would always encourage that you DYOR to be sure of every financial step you would want to take as I won't be liable for any form of loss encountered by you.

Feel free to share with me your thoughts in the comment section. Thanks for your time once again. Gracias!

-------------

**Disclaimer: This post is made as an education and not investment advice. Digital asset prices are subject to change. All forms of crypto investment have a high risk. I am not a financial advisor, before jumping to any conclusions in this matter please do your own research and consult a financial advisor.**

----------

Regards

@lhorgic♥️

-----------

Reference