Steem Alliance

made by canva pro

Friends, you know that when we think about fund management whether it is new or old, we are confused about where to invest and how much to invest, so I am going to write this post about fund management. Let's start.

Crypto asset diversification refers to spreading investments across multiple cryptocurrencies. To manage risk and maximize potential returns. It involves allocating funds to various digital currencies rather than investing in just one single cryptocurrency.

Diversification is important in the crypto market due to its inherent volatility and unpredictable nature. By diversifying your crypto assets. You can reduce the impact of significant price fluctuations in a particular cryptocurrency. This allows you to tap into different opportunities and counter potential losses.

Here are some strategies for diversifying crypto assets I am giving below

Allocate across different cryptocurrencies: Invest in a mix of established cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other promising altcoins. By holding a range of cryptocurrencies you can benefit from potential growth across the market.

Risk and reward balance: Consider the risk-reward profile of each cryptocurrency you invest in. Some may offer higher potential returns but also come with increased risk. Find a balance between more stable established coins and smaller, innovative projects.

Explore different sectors: Cryptocurrencies are used in different sectors such as finance, gaming, decentralized applications and more. Diversify your portfolio by investing in cryptocurrencies from different sectors. Help spread your risk across industries.

Consider Stablecoins: Stablecoins are cryptocurrencies that are pegged to a stable asset like fiat currency. Ensures minimum price volatility. Including stablecoins in your portfolio can provide stability during volatile market conditions.

Stay updated and stay balanced: Monitor crypto markets, news and project developments regularly. Periodically evaluate your investments and make adjustments to maintain a diversified portfolio.

Remember, diversification does not guarantee profits or protect against losses. But it can help manage risk and increase overall portfolio growth potential. Before diversifying your crypto assets you should consult an expert who conducts thorough research. It is advisable to consider your risk tolerance.

**potential benefits of diversifying crypto assets beyond reducing risk**

.png)

made by canva pro

Crypto asset diversification offers a number of potential benefits beyond risk reduction. Here are some additional potential benefits I outline below

Potential for higher returns: By diversifying across different cryptocurrencies you can experience significant growth. Increase the chances of investing in such assets. While some cryptocurrencies may underperform others may outperform the market. leading to higher overall returns for your portfolio.

Exposure to emerging opportunities: The cryptocurrency market is constantly evolving with new projects and technologies emerging regularly. Diversification allows you to use these emerging opportunities and have high growth potential. Potentially benefit from the success of such innovative projects.

Reducing the impact of market volatility: Cryptocurrency markets are known for their volatility. By diversifying your crypto holdings you can reduce the impact of price changes in any single cryptocurrency. When one asset faces a downturn, others in your portfolio may perform better, balancing out the overall impact of market volatility.

Access to different use cases and sectors: Cryptocurrencies serve a wide range of purposes in different sectors such as finance, gaming, decentralized applications and more. Diversifying your crypto assets allows you to participate in different use cases and sectors. Provides exposure to various revenue streams and market dynamics.

Protection against single point of failure: Investing large amounts in a single cryptocurrency carries the risk of single point of failure. If that particular cryptocurrency faces significant problems or fails. Then it can have a substantial negative impact on your investment. Diversification helps reduce this risk because the performance of one cryptocurrency is not entirely determinative of the overall portfolio.

Increased flexibility and liquidity: By diversifying your crypto assets you gain flexibility in managing your investments. It allows you to take advantage of emerging opportunities to reallocate funds as needed. Allows you to rebalance your portfolio as market conditions change. Diversification can also increase liquidity because you have a large number of assets that can be bought or sold based on market conditions.

Remember, while there are potential benefits to diversification, it's essential to do thorough research and understand the risks associated with each cryptocurrency before investing. Maintaining a balanced and diversified approach can help position your crypto portfolio for long-term success.

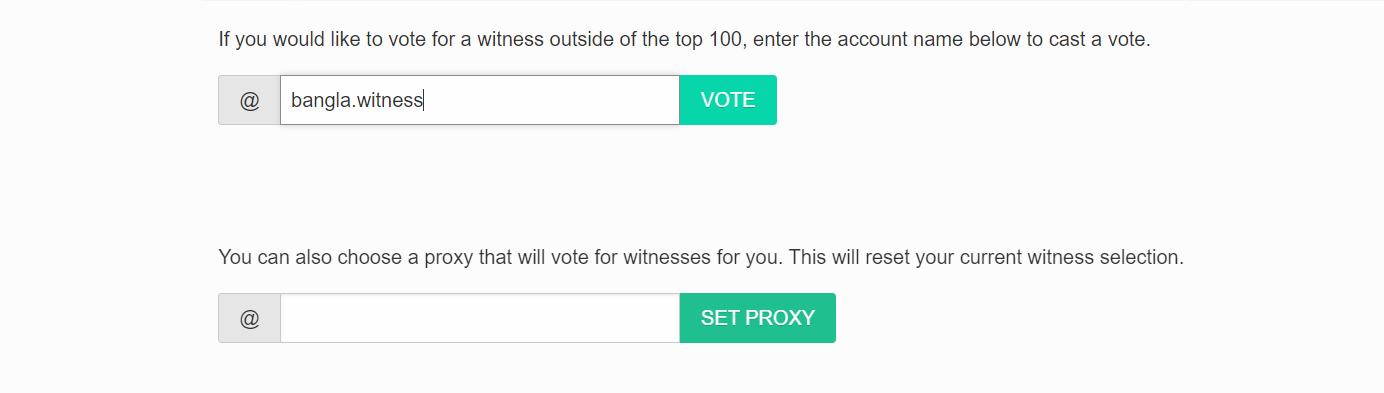

Support @bangla.Witness by Casting your witness vote

VOTE @bangla.witness as witness  OR

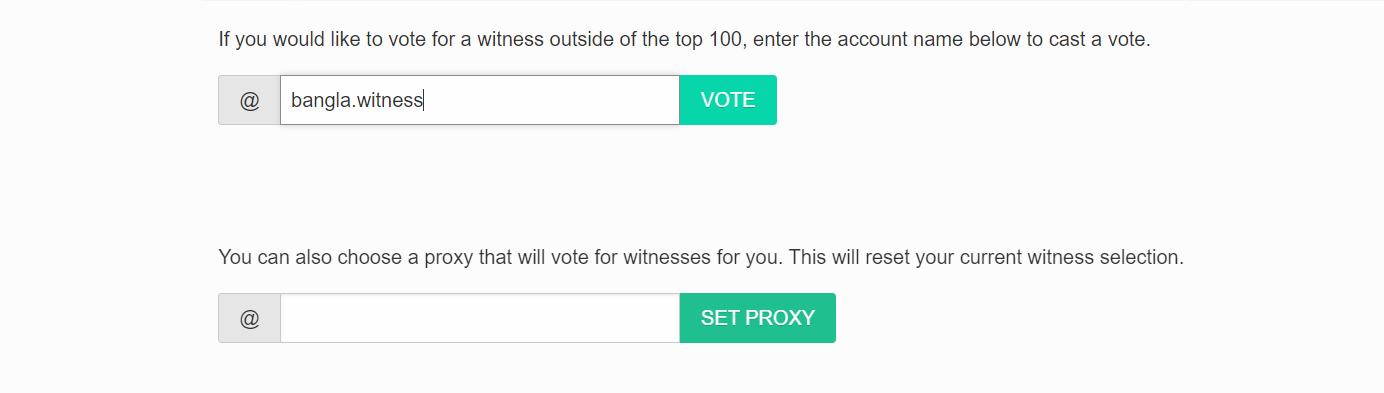

OR

SET @rme as your proxy|

Best regards from Mostofa Jaman|-|