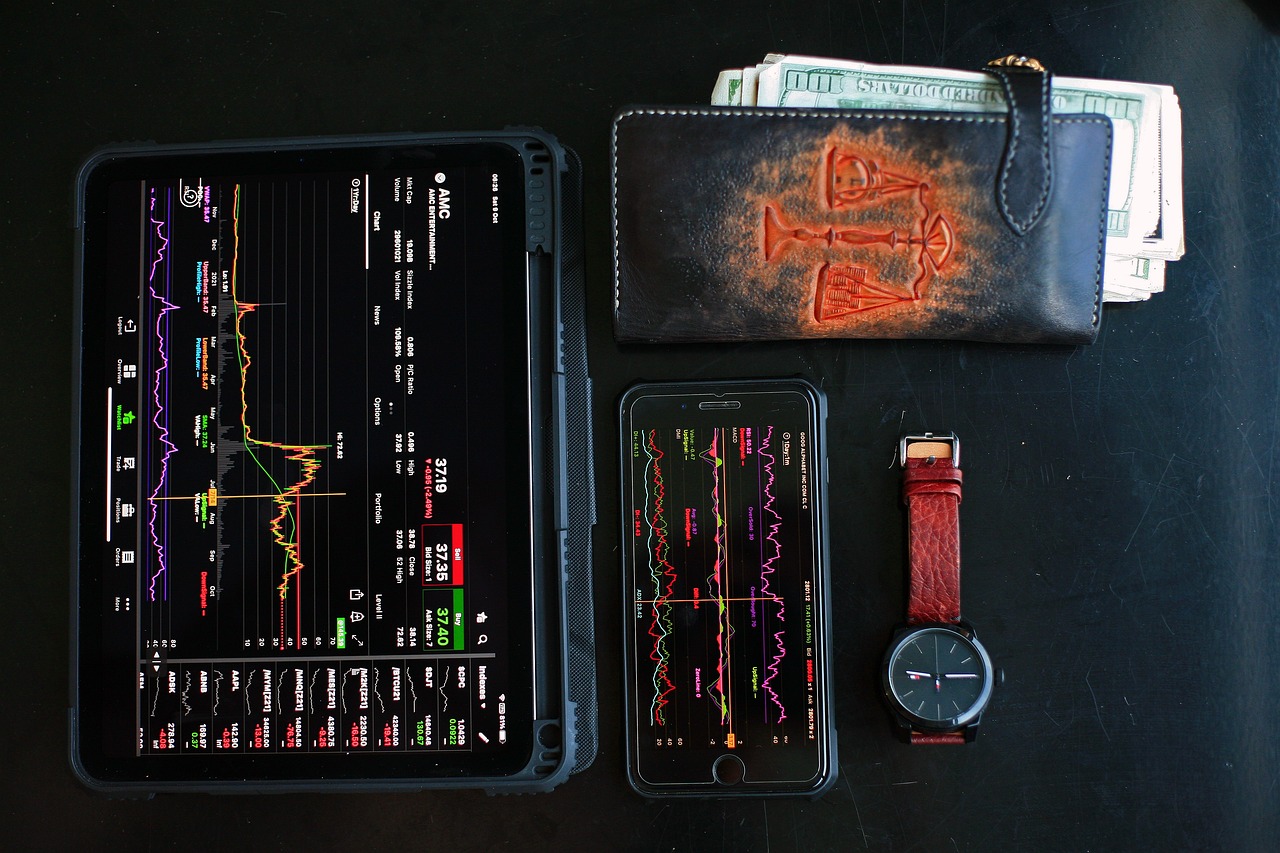

Japanese candle & It’s use

Hellow guys this is rana here. Today is Friday and In this morning I am gonna talk about the feature of japanese candle and it’s use.

It’s a natural think that the use of japanese candle can make a trader successful.

Technical investors utilise Japanese candlestick diagrams to see how the price of financial assets like stocks, currencies, and commodities has shifted. Here's a simple how-to for using them:

Understanding Candlesticks: Made up of parts & dries, every single candlestick represents an exclusive trading period (such as a day or an hour). The wicks represent the fluctuating prices at that time, while the body displays the onset and end of prices.

Understanding Candlestick Patterns: Candlestick layouts shed light on possible price fluctuations as well as business emotion. she, hammer, falling star, enveloping pattern, and other common patterns are examples. Every pattern points to a distinct possible direction for price movement in the future.

Identifying Trends: You could identify trends by looking at the progression of candlesticks. High heights frequently prove indicative of a continuing increase in prices.

With practicing technical analysis on financial markets, Japanese candlesticks are a highly utilised tool, particularly for trading stocks, currencies, and commodities. They become up from multiple candle-shaped charts demonstrating the shifts in prices over a specific period of time. The human form of each and every candlestick is filled or hollow based on whether the closing price was higher or cheaper than the price at the start. Each chart normally indicates the price at the start, ending, high, and low prices over that time. These candlestick patterns might reveal information about possible price movements and market a certain atmosphere.

So That's what I all learn about japanese candle. I thought it will make you guys happy with this technical support. No more today I will write more here about more technical support in coming days.