Bitcoin's rally repeats patterns from 2021

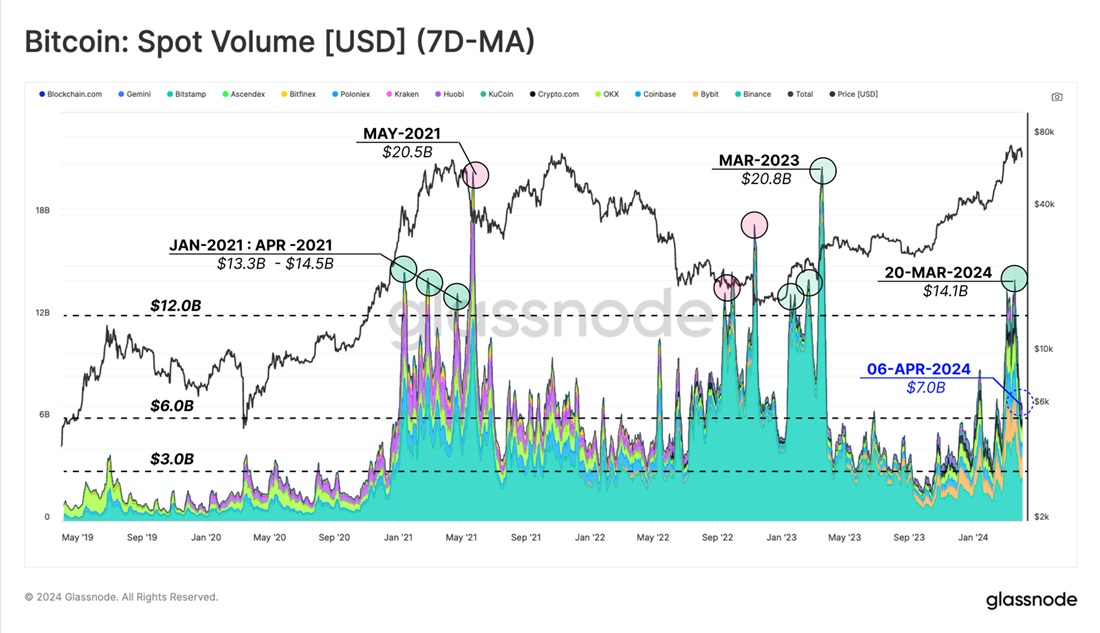

After hitting a then-all-time high in 2021, spot Bitcoin trade volume hit $14 billion per day. The all-time high set this year was also accompanied by a surge in trade volume.

Image source: glassnode.com

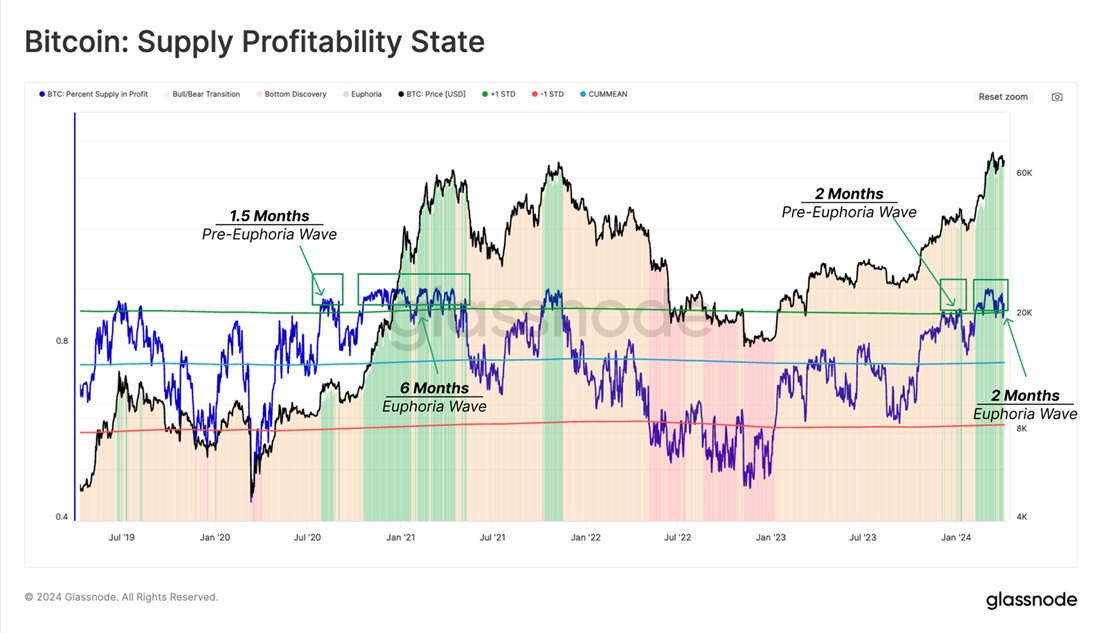

Another striking similarity is the fact that Bitcoin hit the 'pre-euphoria' and 'euphoria' zones when Bitcoin held in profit exceeds one standard deviation.

Image source: glassnode.com

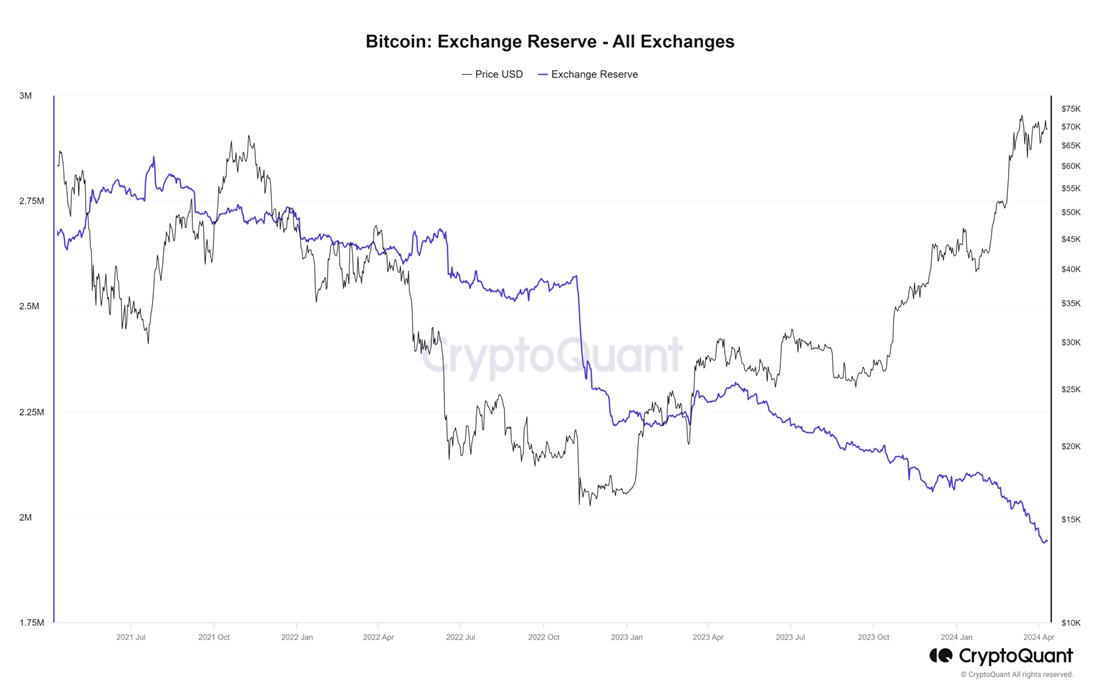

What clearly differentiates these two cycles is the driving force behind them. In 2021, the primary inflow of investments came from institutional investors, while retail purchasers actively used crypto exchanges whose total reserves were 2.9 billion BTC.

Image source: BofA Research

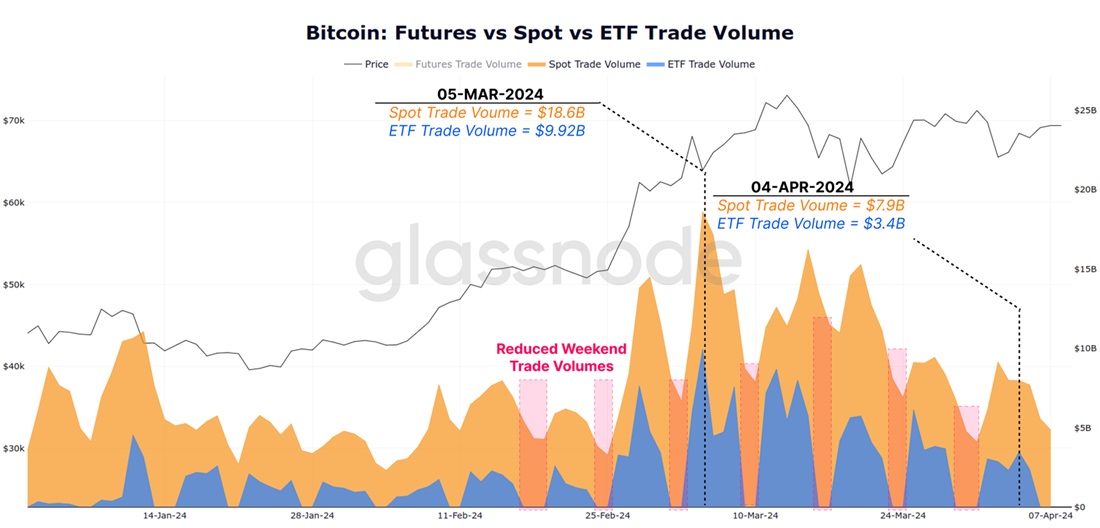

This time, demand primarily came from retail investors, while new ETFs accounted for 30% of spot Bitcoin trade volume. Crypto exchanges' reserves are steadily declining and have already reached 1.94 million BTC.

Image source: cryptoquant.com

The impact of ETFs on spot trading is evident in the decline in market activity on weekends and holidays in the United States, when exchange-traded funds are closed.

Image source: glassnode.com

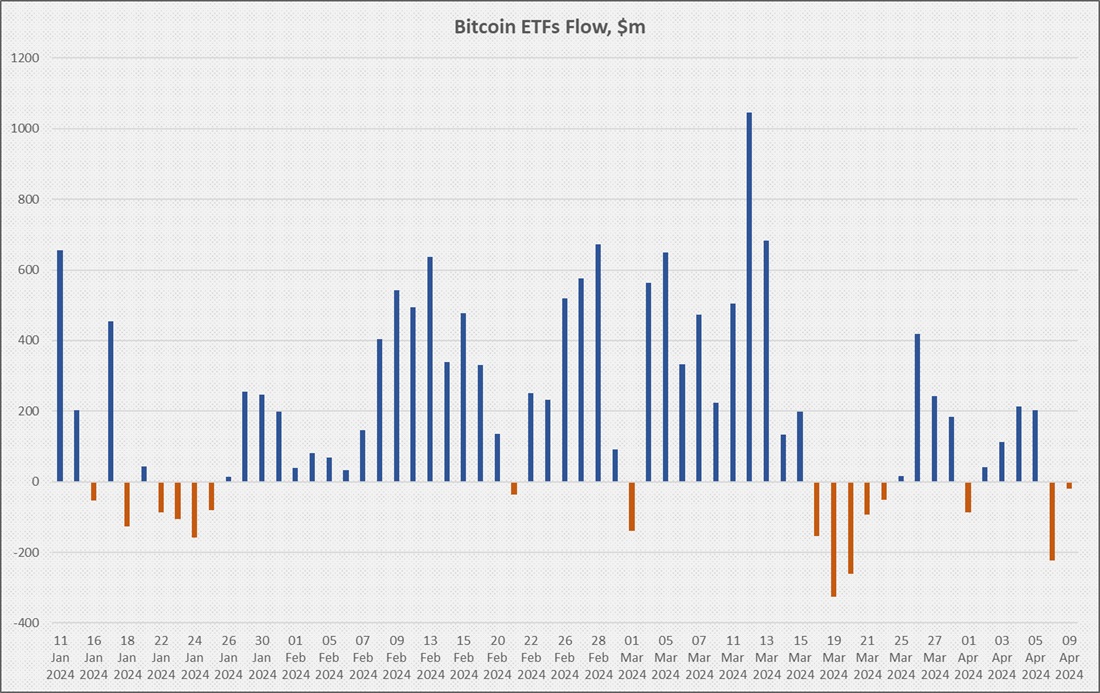

From this, we can draw a simple conclusion: to assess the prospects of Bitcoin's price continuing to rise, we should look at the influx of capital into ETFs and consider other traditional metrics.

Image source: StormGain infographic

During the past two weeks, it's been significantly below the average at $203 million. What's more, the past two days have seen an outflow of funds. This is primarily due to investors leaving Grayscale's fund because it has the highest management fee at 1.5%. In addition to this, Ark Invest's fund also saw an outflow of funds in April, and other ETFs experienced lower inflows.

Image source: StormGain Cryptocurrency Exchange

This, combined with long-term holders and miners selling off their reserves, creates the basis for a correction to form. If we take into account the similarity of the current cycle with the one from 2021, the potential drawdown could be 30% in the 'euphoria' zone. From the all-time high Bitcoin reached, the maximum drawdown target would be around $52,000.

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)