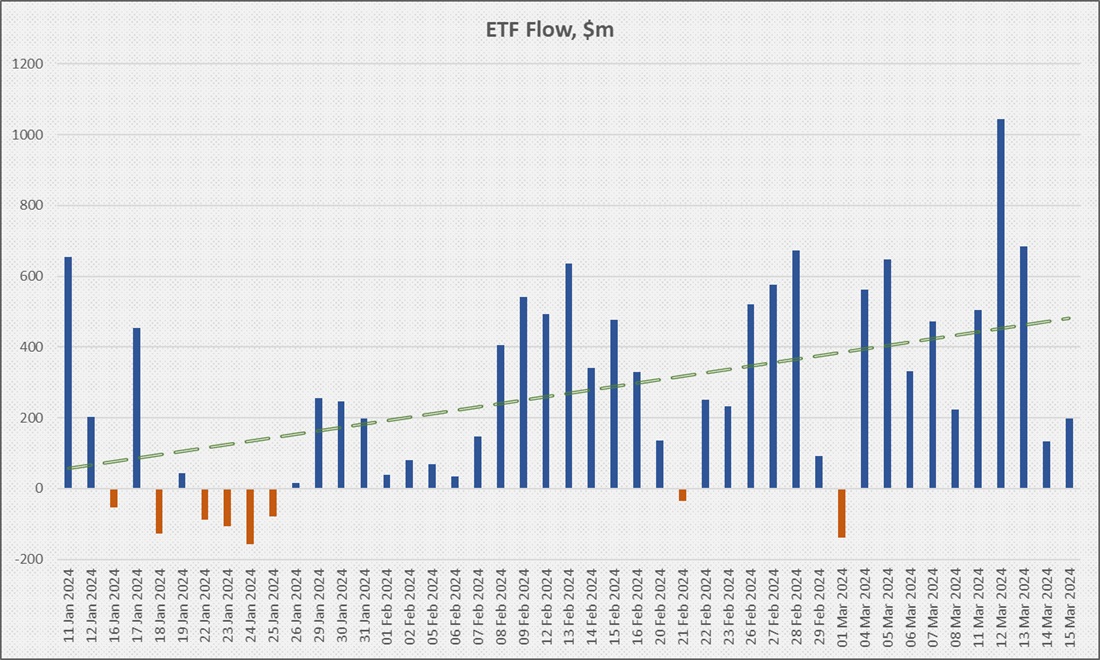

Inflows into Bitcoin ETFs decline sharply

Since February, spot Bitcoin exchange-traded funds have been the leading force on the demand side, driving over 75% of cash inflows into the cryptocurrency. On average, they've attracted $270 million each day since they launched. However, the net inflow last Thursday was $133 million and $199 million on Friday.

Image source: StormGain infographic

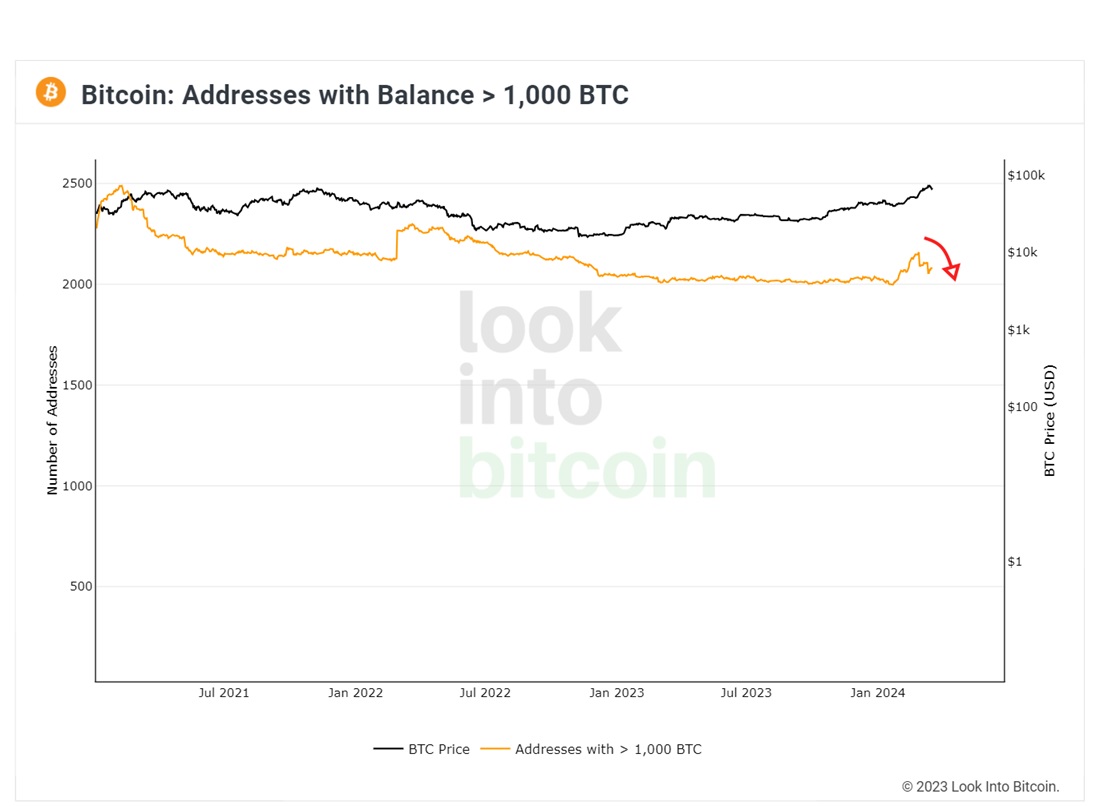

Without a significant boost from ETFs, the price immediately began to undergo a correction since miners, whales, and long-term holders have been engaged in active profit-taking this March. The number of whale addresses (>1,000 BTC) has dropped from 2,159 to 2,081 since the end of February.

Image source: lookintobitcoin.com

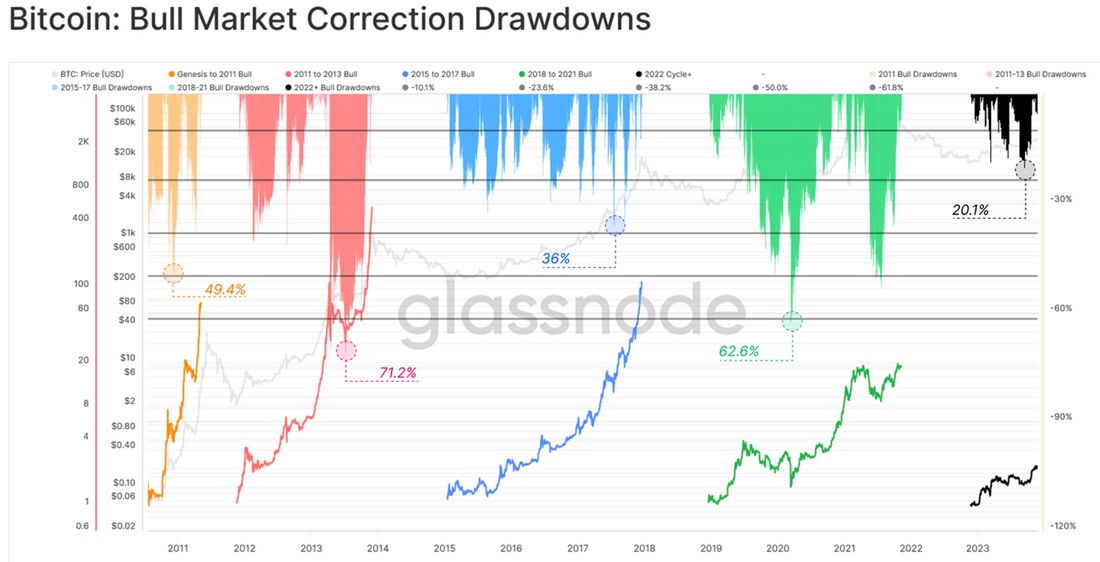

We also warned on 4 March that after a relatively quiet accumulation phase, Bitcoin has moved into a growth phase characterised by corrections of 36% to 71%. It's unlikely that the new cycle will feature smaller drawdowns.

Image source: glassnode.com

And it's all about the spontaneous nature of Bitcoin here. In any traditional market, if the price of an asset drops by 10%, the regulator usually halts trading. But Bitcoin has no such safeguards. Its decentralised nature provides both a high level of freedom and an appropriate response to market overheating from excessive optimism.

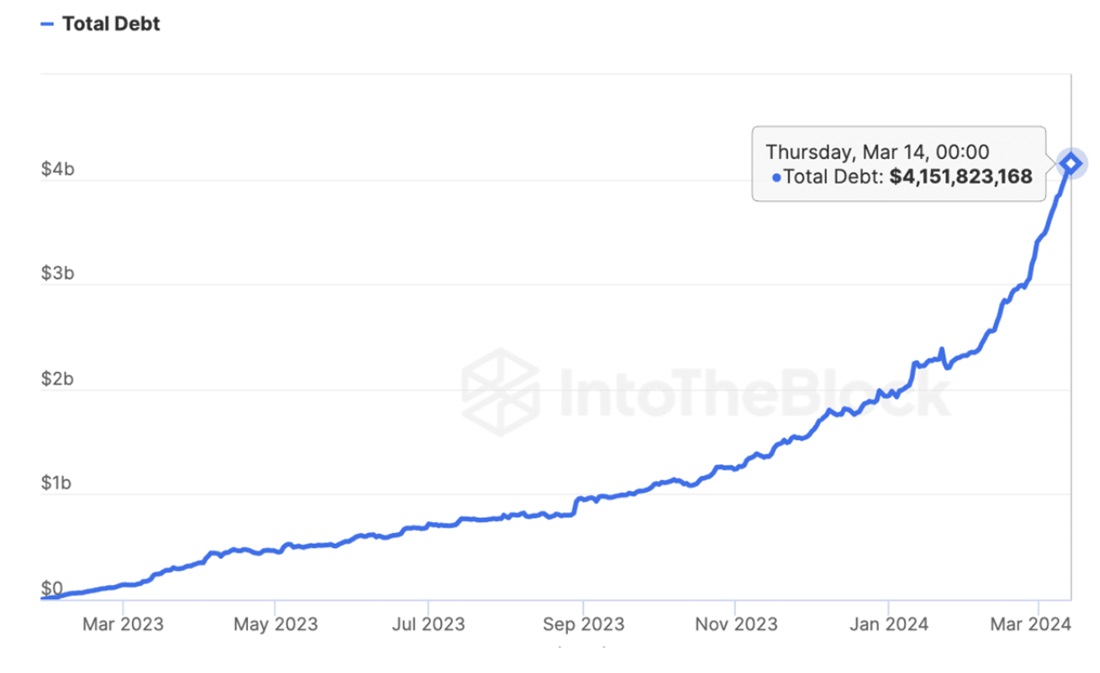

The latter is vividly evidenced by the strongly increased funding rate, rising debt in the DeFi lending market and new record highs for open interest in the derivatives market.

Image source: cointelegraph.com/intotheblock.com

This means that when inflows into ETFs (and especially outflows) stop, Bitcoin will start correcting. The forced closure of traders' margin positions on crypto exchanges and lending platforms will cause an even bigger decline. When some ETF investors see the correction, they'll start panicking and selling off assets. All of this will lead to another chain reaction, and Bitcoin will once again be criticised for its increased volatility.

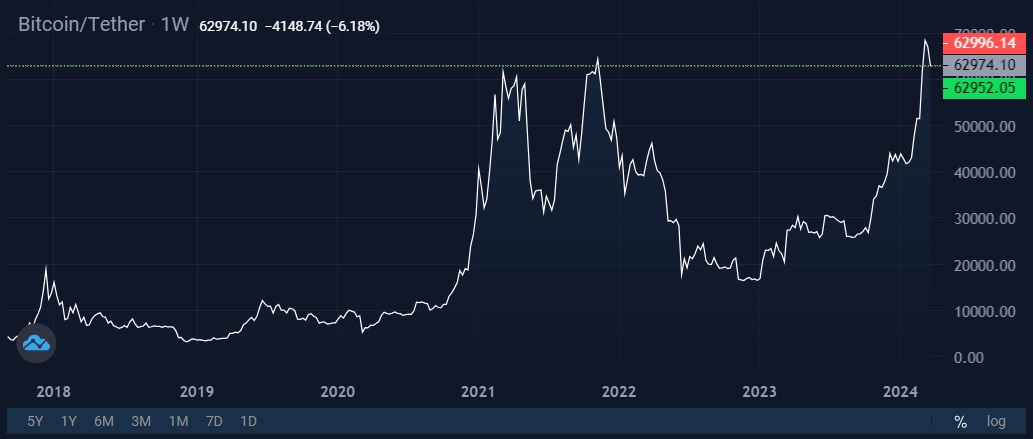

Image source: StormGain Cryptocurrency Exchange

At the same time, the cryptocurrency's long-term prospects remain bright, and a potential correction in no way reduces its chances of hitting the six-figure mark as early as this year.

When planning a strategy, you should rely on the classic "buy and hold" rule, taking the MicroStrategy or El Salvador's approach as an example. Salvadoran President Nayib Bukele, who has been buying a coin a day since November 2022, said, "[El Salvador] won't sell, of course; at the end, 1 BTC = 1 BTC (this was true when the market price was low, and it’s true now)."

StormGain Analytical Group

(platform for trading, exchanging and storing cryptocurrency)