Why Bitcoin Dropped: Should You Panic Now?

Bitcoin has made headlines again after experiencing a significant price drop.

Major Rejection: Bitcoin faced a sharp decline from around $70,000 to approximately $66,000.

Resistance Line: This drop occurred after testing a key downward sloping resistance line.

Is This a Bad Thing?

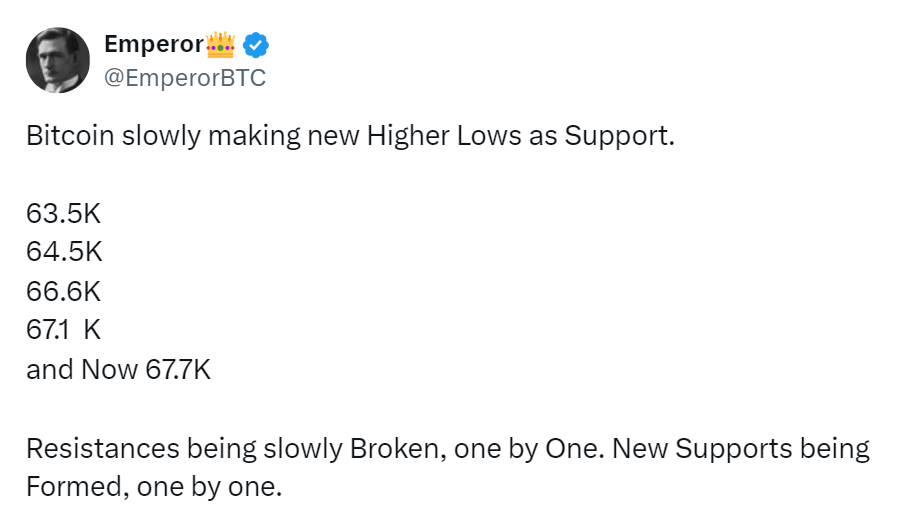

- Healthy Uptrend: While it seems alarming to see such a drop, Bitcoin is still in a healthy uptrend. It continues to form higher lows, which is a positive sign.

- Key Support Levels: Bitcoin is currently testing a crucial support level, which has held strong in the past. This could be an opportunity for a bounce back.

What About the U.S. Government's Actions?

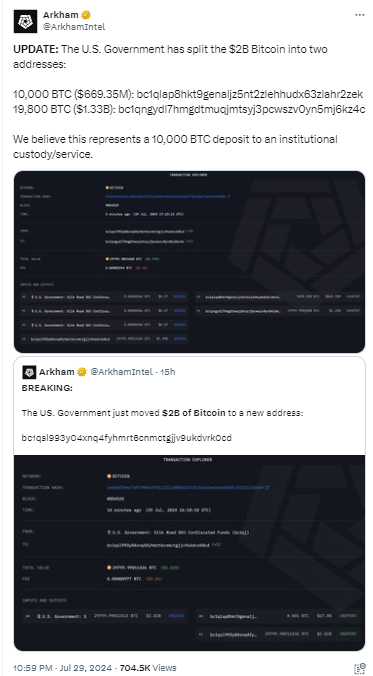

Significant Transfer: The U.S. government recently moved 10,000 Bitcoins (worth about $660 million) to two unknown addresses.

Bullish Interpretation: Analysts believe this move indicates that the Bitcoins may be heading to an institutional custodian service, which is generally viewed as a bullish development.

Current Market Dynamics

Consolidation Phase: Bitcoin has been consolidating for around 156 days. This phase can sometimes extend longer, but it’s crucial for Bitcoin to break the downward sloping resistance to regain upward momentum.

Liquidity Levels: There’s a lot of liquidity building around the $70,000 to $72,000 range. This could serve as a strong support base for potential upward movement if Bitcoin can overcome the resistance.

What Should You Keep an Eye On?

Support at $63,000: As long as Bitcoin remains above the $63,000 support level, the outlook is positive.

Market Reactions: The recent actions from the U.S. government could also indicate a shift toward a more favorable regulatory environment for cryptocurrency.

Rejection might sound concerning, but it’s part of Bitcoin’s natural market behavior. The overall trend is still bullish, especially if Bitcoin holds above that $63,000 support level.

The government’s recent Bitcoin transfer could also signal a change in attitude towards cryptocurrency, potentially boosting prices in the future.