Let's Make A Deal

Trump Said Markets Go Up

.jpg)

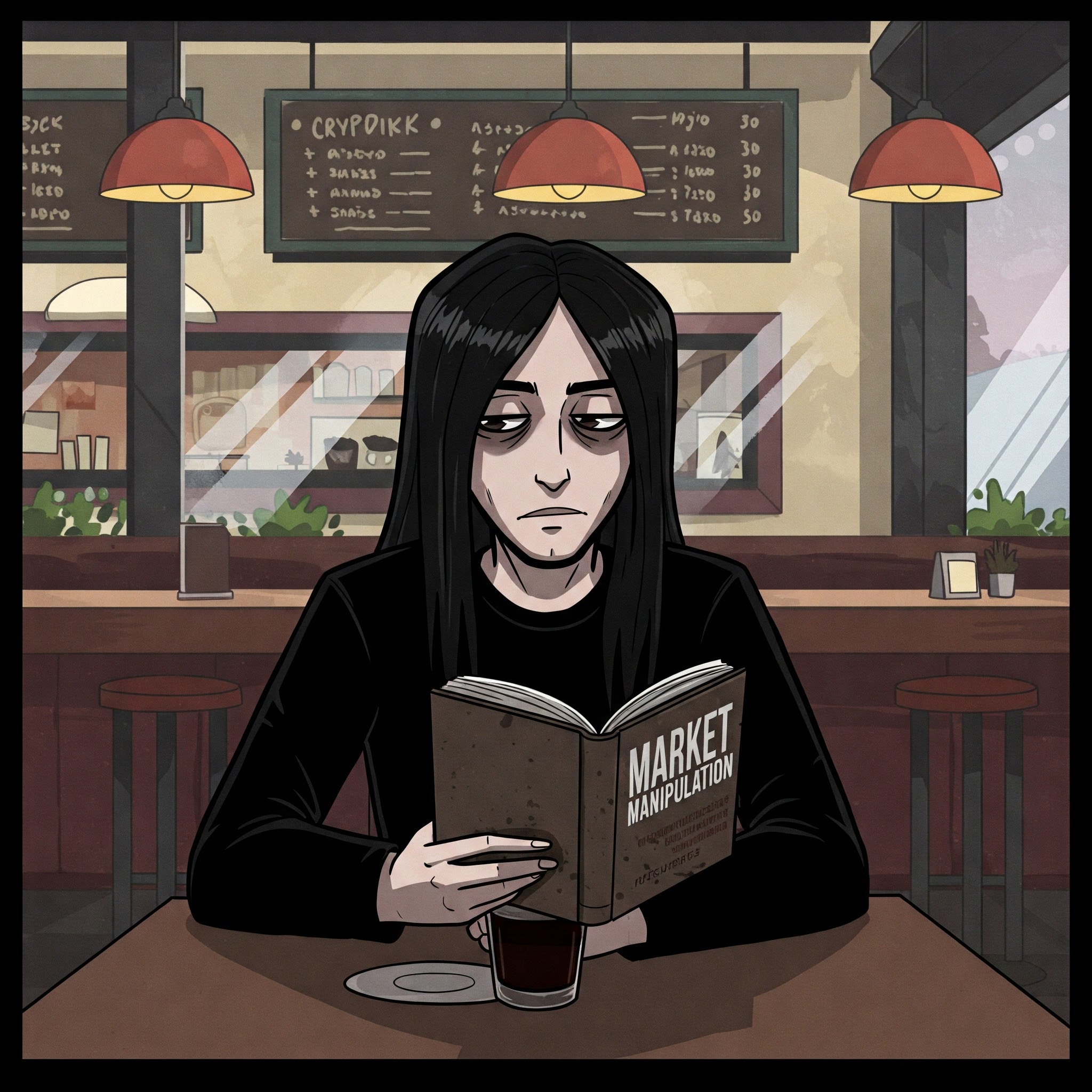

(Setting: A bustling coffee shop, the aroma of roasted beans filling the air. CrypDikk, book open on the table, is scrolling through his phone. Grimr and Glimr's voices echo in his mind.)

Glimr: "See, CrypDikk! I told you! The rebound is here! We're going to the moon! Look at all that green!"

Grimr: "Easy there, Glimr. A strong breeze can still knock us off course. Taking profits after a rally is a prudent move. Don't let euphoria cloud your judgment."

CrypDikk: (Looking up briefly as the barista calls his name) "Exactly. Ride the wave, but don't get wiped out. Selling 10-12% collectively makes sense, especially on those with significant short-term gains. Locking in some of those profits provides a nice cushion."

Glimr: "But selling Nintendo? Even more after that run-up? You were up so much! We could have held out for even higher highs with the Switch 2 buzz!"

Grimr: "But at an all-time high with a modest dividend? Taking some off the table after a 67% gain is just smart risk management. You still hold a portion, so you won't miss out entirely if it continues to climb."

CrypDikk: "Precisely. It's about balancing potential further gains with the risk of a pullback. Same logic with XRX. Multiple sales above $5.70 after a big jump? Smart. Still holding half for that juicy dividend and the Lexmark potential."

Glimr: "Wendy's though? Adding 20% to a losing position? Even with that tasty dividend? Fast food is… well, fast food."

CrypDikk: "It's a small position, Glimr, allowing room to see where it goes. The dividend provides some comfort while waiting, and their brand resonates. Plus, you have to admit, their social media game is strong."

Grimr: "Sentiment doesn't always translate to profits, CrypDikk. But averaging down a small position with a high dividend isn't the worst gamble."

Glimr: "GLPI! Adding more? But with the housing market shifting? Isn't that risky for a REIT?"

CrypDikk: "GLPI focuses on casinos, Glimr. Less directly correlated with the housing market. A solid dividend, back to my average… it felt like a reasonable addition, especially with the broader market looking a bit frothy."

Grimr: "A defensive play in a potentially overheated market. Not a bad idea, CrypDikk."

Glimr: "Energizer? Starting a new position? Batteries? Really?"

CrypDikk: "Steady, reliable, pays a dividend. Sometimes you need those stable players in your portfolio. Oh, and I added a little to my Comcast position as well."

Grimr: "Can't argue with the need for stability and consistent revenue streams."

Glimr: "But selling most of RUN and W after those massive gains? 50% and 58%?! We were on a roll!"

CrypDikk: "And that's exactly why taking significant profits felt right. Those are substantial short-term gains, and with the market rebounding so quickly, some profit-taking reduces exposure if things cool off. Still holding a small amount of those runners in case they have more room to go."

Grimr: "Chasing momentum can be dangerous. Locking in those kinds of returns is often the wiser move."

Glimr: "And exiting LUV entirely? Even with a decent gain?"

CrypDikk: "Small gain, and the airline industry can be volatile. Reallocating that capital felt more strategic."

Grimr: "Agreed. Focus on higher-conviction plays."

CrypDikk: (Picking up his coffee) "Sitting on 8% cash gives us flexibility for future opportunities or if this rebound loses steam. Overall, I feel like we've navigated this bounce well – taking profits where it made sense and strategically adding to a few select positions."

Glimr: "So, we're still aiming for the moon, just with a slightly lighter spaceship?"

Grimr: "More like a well-diversified fleet, prepared for various celestial weather patterns."

(CrypDikk sips his coffee, glancing back down at his book, the market's manipulations now a point of intellectual curiosity after a morning of active trading.)